Goatseus Maximus (GOAT) Gains Momentum Following Key Breakout: Is More Rally Ahead?

Date: Thu, Jan 23, 2025, 12:01 PM GMT

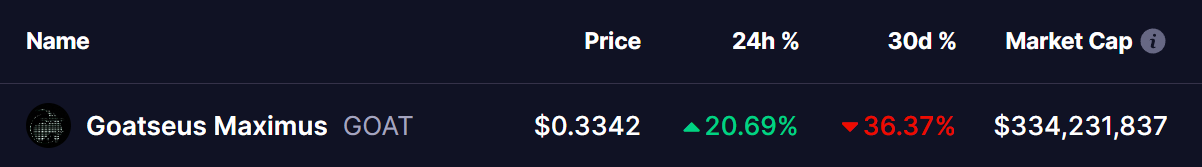

In the cryptocurrency market today, where major memecoins are facing significant corrections with Bitcoin (BTC) down by over 3%, Goatseus Maximus (GOAT) has captured the spotlight. The token has surged with an impressive double-digit rally of over 20% in the last 24 hours, fueled by a key technical breakout.

Source: Coinmarketcap

Source: Coinmarketcap

This rally comes as a potential end to its recent downtrend correction, which saw the token lose over 36% in the last 30 days.

Key Breakout Fuels Rally

Between mid-October and mid-November 2024, GOAT achieved a massive rally, surging by 1795% and reaching a peak price of $1.37. After this explosive growth, the token entered a falling wedge pattern, a consolidation phase that often indicates a reversal or continuation depending on the breakout direction.

Today, GOAT has successfully broken out of this falling wedge pattern at the $0.3172 level, signaling renewed bullish momentum. Following the breakout, the token has moved near a horizontal resistance zone, highlighted by the red-shaded area on the chart. GOAT is currently trading at $0.3340, and retesting the breakout level before approaching the upper boundary of this resistance zone near $0.4180.

A confirmed breakout above $0.4180 could ignite further gains, with the next resistance levels identified at $0.6350, $0.9528, and ultimately the previous high of $1.37. This sequence of targets represents a potential 300% upside from current levels if bullish momentum continues to build.

From a technical standpoint, the MACD (Moving Average Convergence Divergence) indicator is showing signs of a bullish crossover, with the MACD line poised to move above the signal line. Additionally, the histogram is shifting into positive territory, reinforcing the possibility of sustained upward momentum.

Final Thoughts

Goatseus Maximus (GOAT) is gaining attention as one of the top-performing memecoin today, with its breakout from the falling wedge pattern marking a potential turning point. However, traders should watch the price action near the $0.4180 resistance zone, as a failure to break higher could lead to consolidation or a pullback.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.

TRUMP Coin Jumps 70% on President's Dinner Event for Top Token Holders