Meme Coin Mirage: Research Shows Over 76% of Influencer-Endorsed Tokens Fail to Deliver

A recent study reveals the risks of investing in influencer-promoted meme coins, with most losing value rapidly. Experts stress due diligence and risk management.

Recent research by CoinWire highlights the risks of investing in meme coins, especially those promoted by influencers on X (formerly Twitter).

While they promise big profits, the study shows that most of these tokens end up causing major losses for investors.

Influencer-Promoted Meme Coins: The Grim Reality

The promise of quick riches is often tempting, but most investors end up chasing a mirage. A recent CoinWire report analyzed 1,567 meme coins endorsed by 377 influencers over the last three months. The findings are startling: 76% of influencers promote dead meme coins — tokens that have lost over 90% of their value.

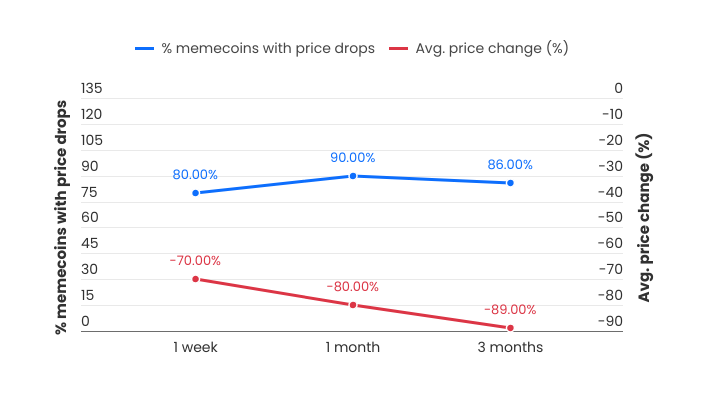

Additional findings include that two-thirds (around 67%) of meme coins promoted by influencers are now worthless. The report also established that after three months, 86% of influencer-promoted meme coins experienced a 10X drop in value. Further, only 1% of influencers have successfully promoted a memecoin that achieved a tenfold gain.

The short-term performance is equally disheartening. After just one week, 80% of promoted meme coins lose 70% of their value. By the one-month mark, losses escalate to 80%.

Influencer-backed Meme Coins Success Rate. Source:

CoinWire Research

Influencer-backed Meme Coins Success Rate. Source:

CoinWire Research

Promotions by influencers often promise exponential gains, creating hype that draws in even inexperienced investors. Yet the data indicates that most of these campaigns prioritize influencer earnings over the quality of the projects promoted.

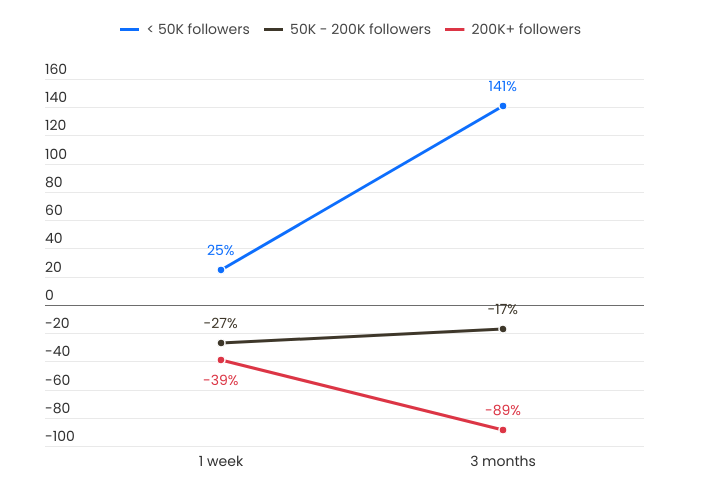

Influencers with over 200,000 followers perform the worst, with an average negative return of 89% after three months. Meanwhile, smaller influencers with less than 50,000 followers offer slightly better outcomes, with some even achieving positive returns over time.

Success Rate of Influencer Predictions based on Followership. Source:

CoinWire Research

Success Rate of Influencer Predictions based on Followership. Source:

CoinWire Research

On average, influencers earn $399 per promotional tweet, incentivizing them to endorse meme coins regardless of their viability. This financial dynamic often leaves their audiences bearing the brunt of the losses.

The Role of X in the Meme Coin Boom

The challenges with influencer-backed tokens are not isolated incidents. BeInCrypto recently reported that 97% of all meme coins fail, with only 15 out of 1.7 million achieving sustained success. The reasons are multifaceted, ranging from lack of utility to poor project management.

The meme coin ecosystem is also rife with controversies. Blockchain investigator ZachXBT recently exposed 16 influencer accounts on X that coordinated pump-and-dump schemes, leaving their followers to absorb the losses. This has fueled debates about the ethical responsibilities of influencers in crypto markets.

Meanwhile, X remains a key platform for promoting meme coins among influencers. The platform’s ability to amplify hype makes it an effective vehicle for meme coin promotions but also a breeding ground for financial risks.

Despite the grim statistics, however, some traders still find opportunities in this volatile market. Crypto personalities like Justin Sun, founder of TRON, suggest evaluating meme coins based on community size, narrative strength, and utility.

Meanwhile, crypto influencer Miles Deutscher recently shared a four-step meme coin trading plan: focus on market timing, analyze tokenomics, understand project fundamentals, and manage risk through stop-loss strategies. Taken together, these approaches reflect the importance of caution and due diligence.

While the hype surrounding meme coins is undeniable, this context highlights the need for caution. Influencer endorsements, though enticing, are not reliable indicators of a token’s potential. Investors should scrutinize projects, considering factors like utility, community engagement, and long-term viability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

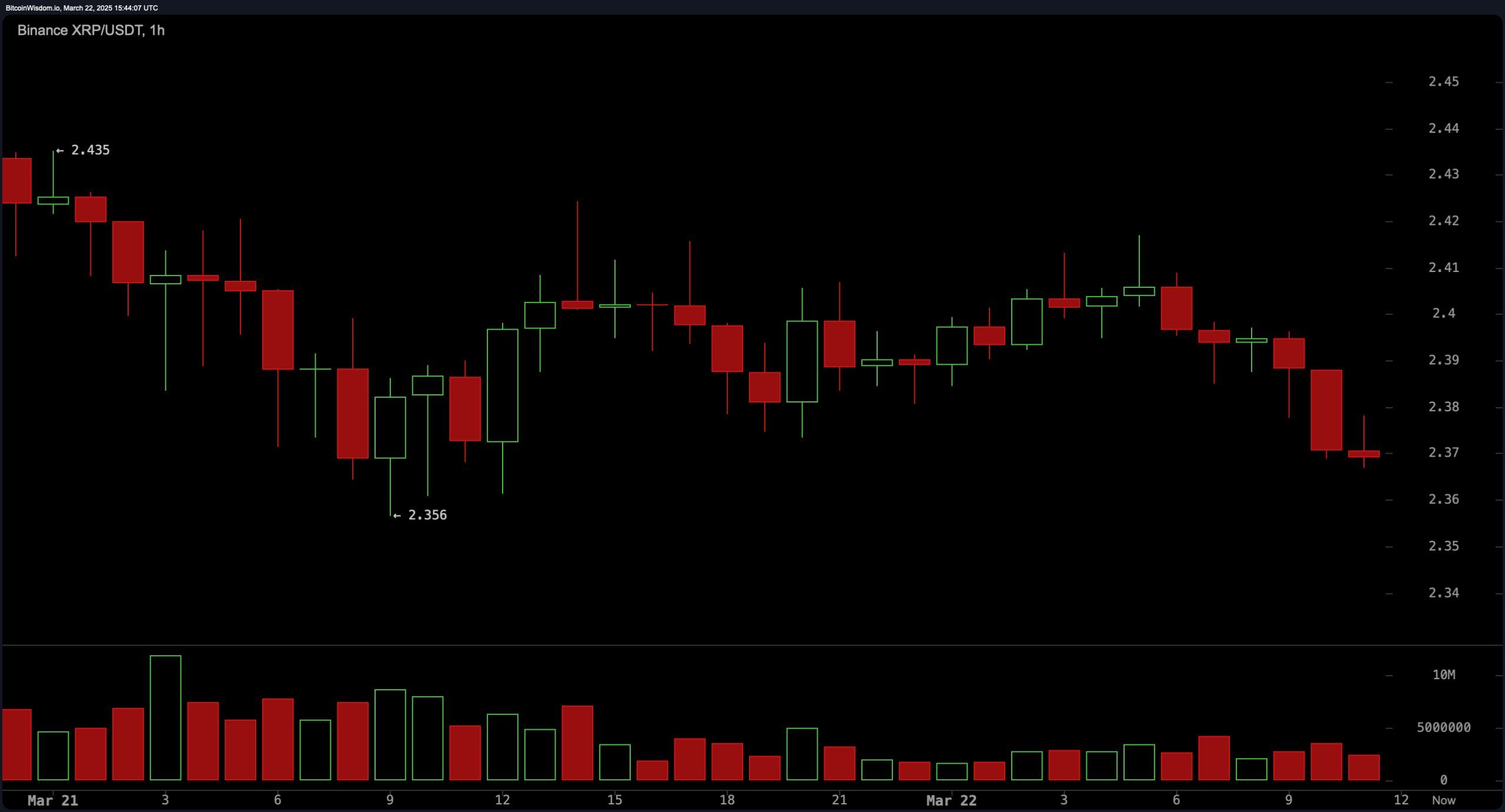

XRP Price Update: XRP Teeters on $2.35 Support—Next Move Critical

Weekly Crypto Regulation News Roundup: SEC Ends Ripple Case, Trump Calls for Stablecoin Regulation

Regulatory realignment unfolds as the SEC steps away from a prolonged crypto case while policy makers rally for simple stablecoin rules to reshape market oversight and boost investor confidence.

BaFin Bans Ethena’s USDe Token in Germany Over Approval Process Flaws

German regulators’ latest clampdown forces crypto issuers to rethink internal controls—a potential catalyst for industry-wide reform that could reshape how synthetic tokens meet EU compliance standards.

Crypto Industry Super PAC Endorses Republican Candidates in Florida Special Elections

The network includes Fairshake, Protect Progress, and Defend American Jobs, the latter taking the lead in campaign spending.