Why These Altcoins Are Trending Today — November 18

Comedian (BAN), Akash Network (AKT), and Sui (SUI) dominate crypto trends, fueled by Binance listings and bullish technicals. Here’s what’s driving their momentum.

The cryptocurrency market is buzzing with activity as several altcoins have stolen the spotlight today. From double-digit price surges to rising trading volumes, these trending altcoins, and notably — meme coins, are gaining a lot of market attention.

Key factors driving the momentum include surging social dominance, significant whale accumulations, and unexpected exchange listings. Notably, Comedian (BAN), Akash Network (AKT), and Sui (SUI) are among the top trending altcoins today, November 18.

Comedian (BAN)

Comedian (BAN), a meme coin based on Solana, is among today’s trending altcoins due to a surprise Binance futures listing. Earlier today, Binance disclosed that it will list the altcoin at 11:30 UTC, and traders can use up to 75x leverage.

Apart from Binance, Bybit also announced that it will list the token. As a result, BAN’s price has increased by 82% in the last 24 hours. Its trading volume has also increased by 300% and currently sits at $255 million, indicating that investors have shown significant interest in the token.

From a technical perspective, the 4-hour chart shows that BAN’s price has risen above the Ichimoku Cloud, a technical indicator that gauges support and resistance.

Comedian 4-Hour Analysis. Source:

TradingView

Comedian 4-Hour Analysis. Source:

TradingView

When the price is below the cloud, it means there is a strong resistance that could push the price down. But since it is above it, it means BAN’s price might continue to climb above $0.30.

If this is the case, the altcoin’s price could rise to $0.43. On the other hand, if selling pressure comes into play, the token could drop to $0.20.

Akash Network (AKT)

The AI-based project Akash Network, which focuses on decentralized computing, is one of the top trending altcoins today. Like the Comedian project, AKT is trending because Binance is also listing on the futures market.

Following the development, AKT’s price rallied to $4.25 before it recently dropped to $3.73 at the time of writing. On the daily chart, the Awesome Oscillator (AO) reading has increased. The Awesome Oscillator (AO) analyzes current data against historical data to gauge market momentum. It helps confirm or challenge existing trends, identify whether a trend is bullish or bearish

When the reading is negative, the momentum is bearish. However, since it is positive, momentum is bullish, suggesting that AKT’s price could continue to rise. As seen on the daily chart, the price could climb to 4.52 gain, which is the highest point for the candlestick’s wick.

Akash Network Daily Analysis. Source:

TradingView

Akash Network Daily Analysis. Source:

TradingView

However, if the hype around the Binance listing drops, this could be invalidated. In that scenario, AKT could decline to $2.91

Sui (SUI)

Sui is again on the list of trending coins today because of the market interest in it. However, it is important to note that the layer-1 blockchain did not have any major development.

At press time, SUI’s price was $3.67, down 6.60% from its all-time high. Despite the decline, the Average Directional Index (ADX), which measures directional strength, suggests that SUI’s price might continue to climb.

This is because the ADX reading has increased, and since SUI’s movement has been toward the upside for some time, the value might continue to rise. If this happens, the altcoin’s value could rise above $4.

Sui Daily Analysis. Source:

TradingView

Sui Daily Analysis. Source:

TradingView

However, if the indicator’s reading slides below 25, the uptrend could become weak. In that scenario, the price could decline below $2.38.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

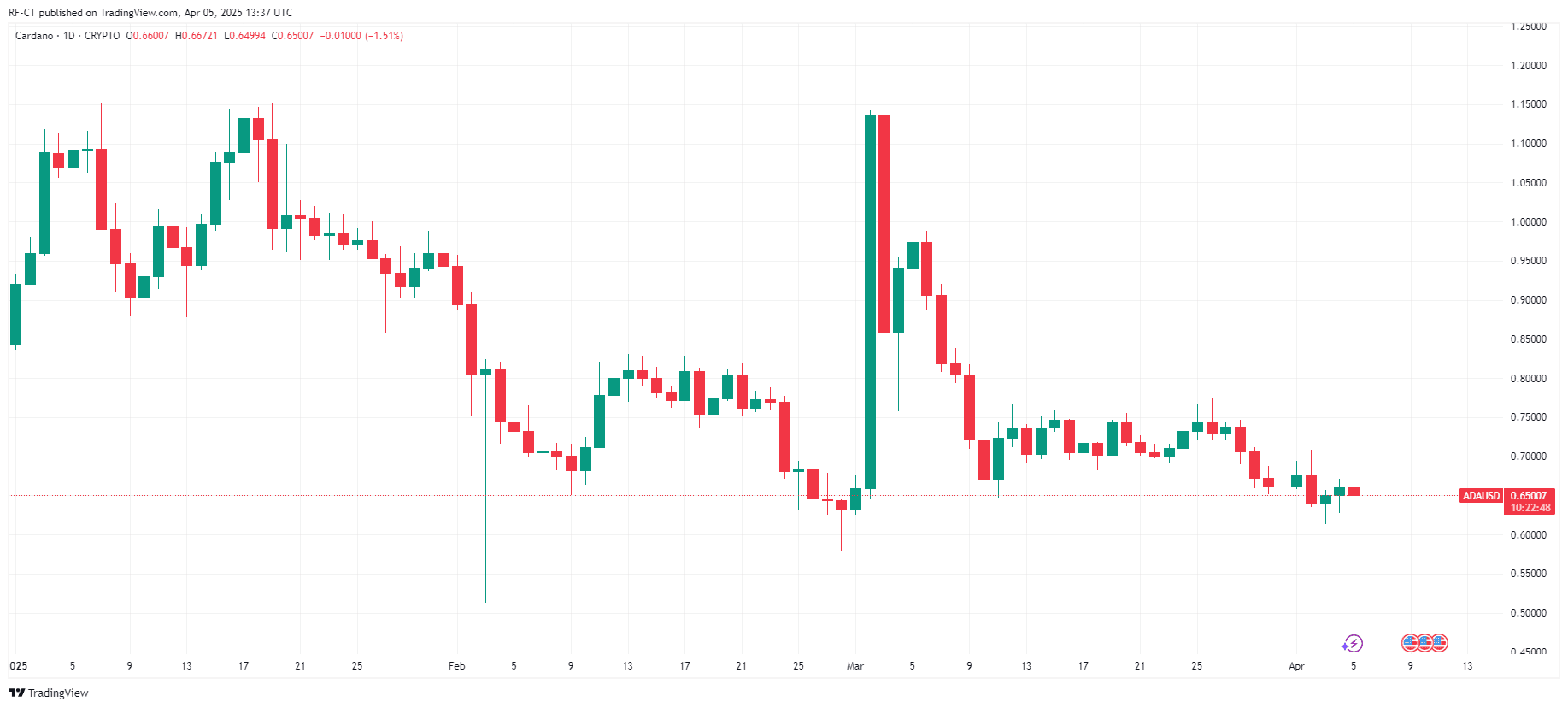

Cardano Price Prediction 2025: Will BTC Integration Push ADA Price to $3 or $5?

Cardano’s ADA First 'Death Cross' in 2025 Fast Approaching: What’s Next?

Polymarket Bettors’ Recession Odds Surge Over 50% Amid Brutal 2 Day Market Decline

As Wall Street tumbles on tariff fears, some online prediction markets share a growing certainty of a recession well before economists reach a consensus.

Liberation Day for Bitcoin Price – Is $100k Within Reach?