Uptober forming with rising stablecoin liquidity and Bitcoin transactions

CoinDesk's daily newsletter, First Mover, featured an article discussing the current state of the crypto market. The article highlighted the formation of "Uptober" due to increased stablecoin liquidity and Bitcoin transactions. Ether ETFs experienced significant outflows, while Bitcoin broke the $64K mark and gold prices soared. The ETH/BTC ratio reached its lowest point since April 2021, leading to questions about Bitcoin's bullish momentum. The CoinDesk 20 Index closed at 1,997.20, down 0.53%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PayPal Expands Portfolio with Solana and Chainlink Aiming for Greater Cryptocurrency Flexibility

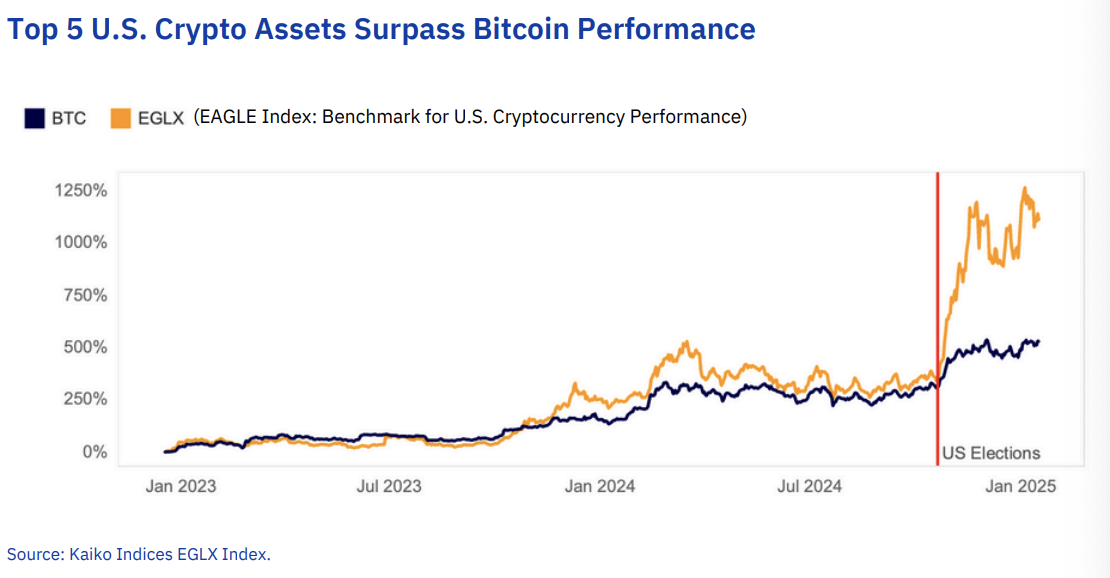

Altcoin volumes are ‘more concentrated’ than ever

Altcoin trade volume has returned to pre-FTX levels, but with a shrinking pool of market leaders

XRP price sell-off set to accelerate in April as inverse cup and handle hints at 25% decline

US Treasury Targets Houthi Crypto Wallets, Financial Network