Comparing Airdrops vs ICOs: How They Affect Token Supply and Market Sentiment

ICOs typically set a lock-up period to reduce the pressure of early selling, while airdrops rarely take such restrictions.

Original source: Tokenomist

Original translation: TechFlow

1. Overview of Airdrops and ICOs

· Airdrops:Distributing tokens for free, usually to increase brand awareness, reward early users, or connect with the community.

· ICO (Initial Coin Offering):A fundraising activity during which projects sell tokens in advance to obtain funds to help them realize their project vision.

2. The impact of airdrops on token supply

· Increased circulating supply:Airdrops quickly introduce tokens to the market, often triggering inflationary pressures and market volatility.

· Market sentiment:While airdrops can create excitement, a large influx of tokens into the hands of recipients can lead to sudden sell-offs that can affect token prices.

Example: Scroll’s recent airdrop initially traded at $1.40, but after recipients claimed and sold tokens, the price dropped to $0.77, a change that reflects the price volatility that is common after airdrops.

Through the above analysis, we can see the different roles of airdrops and ICOs in the token market and how they affect token supply and market sentiment.

3. The impact of ICOs on token supply

· Controlled release mechanism: ICO tokens are usually distributed gradually, with monthly or quarterly unlocking. While this approach can stabilize supply in the early stages, it can lead to market volatility as early investors sell off.

· Demand-driven valuation: Although ICOs generate initial market demand, regular token unlocking can affect prices, sometimes creating downward pressure and thus affecting market sentiment.

4. The main differences in token economics

· Locking and unlocking: ICOs usually set a lock-up period to reduce the pressure of early selling, while airdrops rarely take such restrictive measures.

Through the above analysis, we can see the unique role of ICOs in token supply and market dynamics, as well as their key differences from airdrops in token economics.

· Governance risk:Airdrops distribute tokens to a wide range of users, which makes governance decisions face uncertainty as voting results become more difficult to predict.

· Inflation management strategies:Some projects deal with the inflation risk brought about by airdrops through destruction mechanisms or staking incentives, aiming to maintain the value of tokens and encourage users to hold them for the long term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?

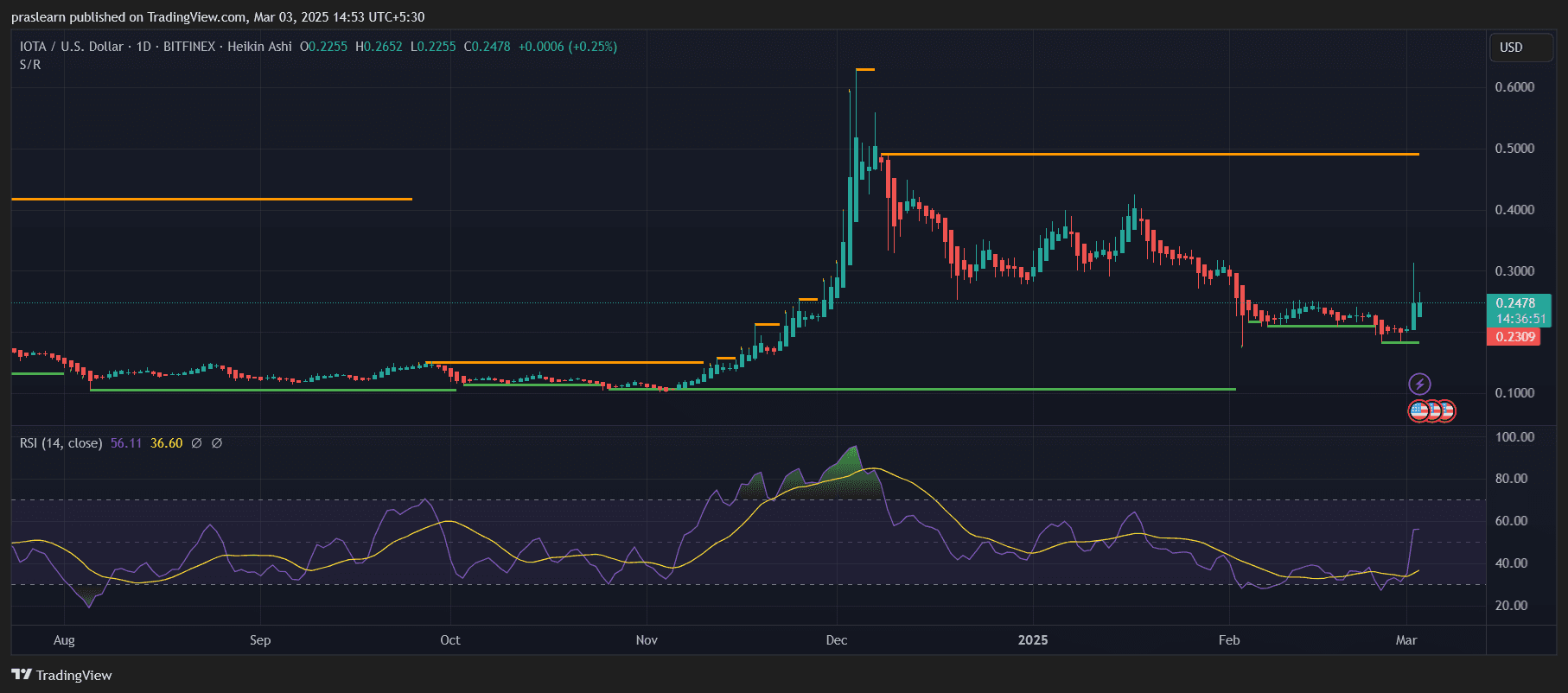

IOTA Price Prediction: Is This the Start of a Major Reversal?

Aave Price Prediction: Is the Correction Over or More Pain Ahead?

Why March 7 Is Crucial for Bitcoin and the Broader Crypto Market