Cross-chain bridge new star deBridge, revenue approaching tens of millions of dollars, with an expected increase in token prices

远山洞见2024/10/15 08:30

By:远山洞见

I. Project introduction

deBridge is a bridge protocol that provides efficient and secure cross-chain interoperability for the Web3 ecosystem, allowing users and protocols to transfer arbitrary messages and assets between different blockchains in a decentralized manner. The project ensures the security and efficiency of cross-chain transactions through a network of independent validators selected by deBridge's decentralized governance system. deBridge aims to become the "Internet of Liquidity" and plans to build a fully decentralized cross-chain asset transfer ecosystem by gradually introducing DBR tokens and DAO governance. The project has been successfully deployed on multiple mainstream blockchains, including Solana and EVM chains.

II. Project highlights

1. Efficient and secure cross-chain transmission: deBridge, as a cross-chain bridge project, supports the decentralized transmission of arbitrary messages and assets between different blockchains. Its independent validator network ensures the security and efficiency of each transaction, making it one of the fastest and most secure cross-chain solutions on the market.

2. Innovative point rewards and token economy: deBridge allows users to earn points when conducting cross-chain transactions through its point reward system, which is proportional to the protocol fee and motivates users to continue participating. In the future, DBR tokens will be launched, and users can participate in decentralized governance by staking tokens, influencing key decisions of the protocol.

3. Unlocked liquidity model: Unlike traditional cross-chain bridges that rely on liquidity pools, deBridge adopts an unlocked liquidity model, which eliminates the need to lock large amounts of liquidity in advance. This design greatly improves capital efficiency, reduces security risks, and ensures more flexible and secure cross-chain asset transfer.

4. Extensive multi-chain support and continuous expansion: deBridge has supported multiple mainstream blockchains, including Solana and EVM chains. In the future, it will further expand to ecosystems such as Tron and Cosmos, and plans to launch cross-chain transaction functions for native Bitcoin, continuously expanding its cross-chain interoperability.

III. Market value expectations

As a cross-chain interoperability protocol, deBridge ($DBR) has established its position in the cross-chain bridge market with its unique lock-free liquidity model and decentralized governance mechanism. With the development of the project and the integration of more blockchains, the value of the $DBR token is expected to have significant growth potential.

According to the latest data, the unit price of $DBR token is 0.0273 dollars, with an initial circulation market value of about 45 million dollars and an initial FDV (fully diluted market value) of 273 million dollars. To better predict the future potential of $DBR, we can analyze it by benchmarking it against the market value of other cross-chain interoperability protocols.

Benchmark project:

Omni Network ($OMNI) : The interoperability layer of Ethereum, with a token price of 9.92 dollars and a circulating market cap of $90,804,877.

Celer Network ($CELR) : a blockchain interoperability protocol with a token price of 0.0142 dollars and a circulating market value of $110,505,487.

LayerZero ($ZRO) : a full-chain interoperability protocol with a token unit price of 4.09 dollars and a circulating market value of $455,274,696.

Assuming the market value of deBridge reaches the level of these benchmark projects, the expected price and increase of the $DBR token are as follows:

Benchmarking Omni Network ($OMNI) : The circulating market value is $90,804,877, and the price of the $DBR token is about $0.0555, an increase of 2.03 times.

Benchmarking Celer Network ($CELR) : The circulating market value is $110,505,487, and the price of $DBR token is about $0.0670, an increase of 2.45 times.

Benchmarking LayerZero ($ZRO) : The circulating market value is $455,274,696, and the price of $DBR token is about $0.2766, an increase of 10.13 times.

IV. Token economy model

The native token $DBR of deBridge is the core of the entire project ecosystem, mainly used for governance, staking, and Incentive Mechanism. The following is the key economic information of the $DBR token.

Token details :

Token Ticker: $DBR

Total number of tokens: 10 billion

Initial FDV (Fully Diluted Valuation): 250 million USD

Token Distribution and Release Model :

Foundation (15%) : 33.3% will be released during TGE (token generation event), and the remaining part will be linearly released within 3 years after 6 months of lock-up.

Ecological reward (26%) : 11.5% is released during TGE, and the remaining part is linearly released within 3 years after 6 months of locking.

Core contributors (20%) : TGE no release, after 6 months of lock-up, linear release within 3 years.

Community and liquidity (20%) : 50% is released at TGE, and the remaining part is linearly released within 3 years after 6 months of locking.

Strategic Partner (17%) : Release 20% during TGE, after 6 months of lock-up, the remaining part will be linearly released within 3 years.

Validator (2%) : Release 20% during TGE, after 6 months of lock-up, the remaining part will be linearly released within 3 years.

Initial circulation :

The initial circulation of the project is 1.80 billion, accounting for 18% of the total.

The initial market capitalization is approximately $45 million.

Token Economy Analysis : Among the 1.80 billion tokens initially circulated by deBridge, the project party holds a large proportion. As the token release model progresses, the supply of tokens in the market will gradually increase. Due to the relatively high initial circulation market value and initial market pressure, the attractiveness of the token economy model to early investors may be challenged. Investors need to closely monitor the rhythm of token release and the subsequent ecological development of the project to balance the potential impact of supply pressure.

V. Team and financing

Team Info

- Alex Smirnov : Co-founder, responsible for technology and strategic direction.

- Jonnie Emsley : CMO, responsible for marketing activities and brand operations.

- Gal Stern : Head of Business Development, responsible for global business development.

Financing information

- Seed round financing : $5.50 million

- Time : September 7, 2021

- Key investors : ParaFi Capital, SkyVision Capital, GSR, Animoca Brands, Crypto.com Capital, MEXC Ventures, etc.

VI. Risk Warning

Token economy risk : The proportion of initial circulation tokens in the project is relatively high, with an initial circulation market value of 45 million US dollars and FDV of 250 million US dollars. Although a considerable number of tokens will be locked and linearly released, the initial circulation is too large, which may lead to greater market selling pressure, especially for early investors and project parties. The unlocking time is short, and there may be a risk of liquidity imbalance in the market.

Market competition risk : deBridge, as a cross-chain bridge project, has fierce market competition. There are already many mature projects in the cross-chain bridge track, such as Wormhole, Synapse, Multichain, etc., which have leading advantages in market share and technology. deBridge has good infrastructure and community support, but the future market share competition may encounter greater competitive pressure.

Technical security risks : Cross-chain bridge projects usually face high security risks. There have been many incidents of cross-chain bridges being hacked in history, causing serious losses in capital. deBridge's technology emphasizes security, but still needs to continue to prove its anti-attack ability, especially in the case of increased transaction volume and user interaction.

Sustainability of community active level : Although deBridge's social media and community data are currently performing well, there is still uncertainty as to whether it can maintain this popularity in the future. Declining user engagement rate and participation may affect the overall development of the project and the stability of token prices.

VII. Official links

Website :

https://debridge.finance/

Twitter:

https://x.com/deBridgeFinance

Telegram:

https://t.me/deBridge_finance

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

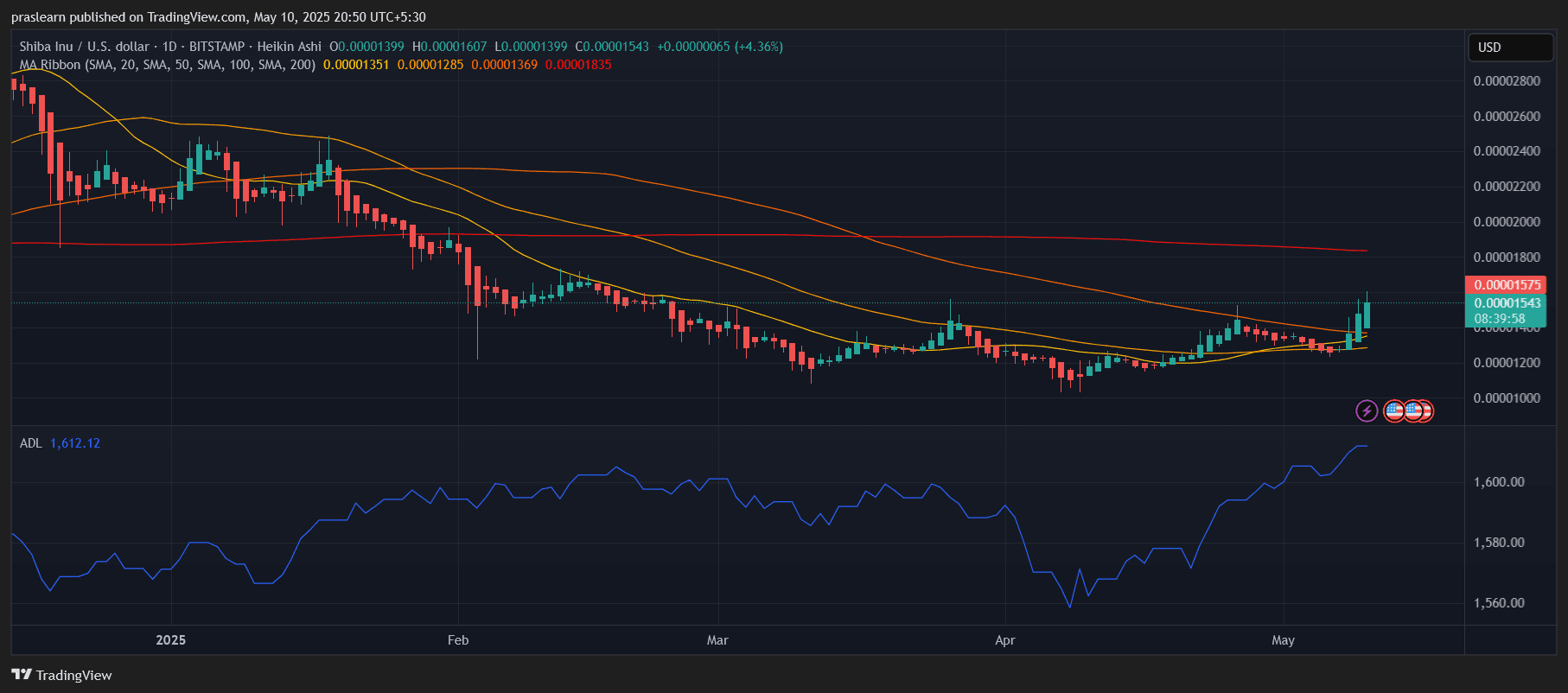

Shiba Inu Price Prediction: Ready for 500% Gains?

Cryptoticker•2025/05/11 04:00

Solana Price Prediction: Superstate’s SEC-Approved Platform Could Drive a 10x Run

CryptoNews•2025/05/11 01:33

Saylor Says Bitcoin Stalled Below $150K on Weak Hands as Bulls Eye BTC Price Rally

“A lot of Bitcoin, for whatever reason, was left in the hands of governments, lawyers, and bankruptcy trustees,” Saylor noted.

CryptoNews•2025/05/11 01:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$104,146.67

+0.96%

Ethereum

ETH

$2,537.03

+8.73%

Tether USDt

USDT

$0.9999

-0.01%

XRP

XRP

$2.41

+2.07%

BNB

BNB

$664.98

+1.01%

Solana

SOL

$176.86

+3.62%

USDC

USDC

$0.9999

-0.01%

Dogecoin

DOGE

$0.2409

+15.47%

Cardano

ADA

$0.8183

+5.19%

TRON

TRX

$0.2672

+1.72%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now