CeDeFi pioneer Unizen, token may see a 669% increase

远山洞见2024/09/26 07:26

By:远山洞见

I. Project introduction

Unizen is an innovative CeDeFi trading platform and operating system focused on the Web3 ecosystem, aiming to provide users with seamless and secure cross-chain asset management and application interaction experience. Unizen combines the security of CeFi with the decentralized advantages of DeFi, simplifying the user's operation process between different blockchains and solving the complexity problems faced by users in multi-chain ecosystems. It allows users to trade digital assets on multiple blockchains through a unique cross-chain DEX aggregator, while providing efficient and low-cost cross-chain asset transfer through the Unizen Interoperability Protocol (UIP).

The biggest feature of Unizen is its ability to find the most cost-effective trading path across multiple exchange modules (including Binance), providing users with the best prices and execution efficiency. Through its integrated intelligent trading engine, users can complete various Web3 transactions and application interactions in a one-stop interface, eliminating the complexity of using third-party bridging tools and illiquid exchanges.

In order to further enhance User Experience, Unizen has developed an advanced Liquidity Allocation Mechanism (ULDM), which greatly reduces slippage issues in trading. By integrating private market makers (PMM) liquidity, it ensures the stability and accuracy of block trading. Unizen's goal is to simplify Web3 interactions, reduce transaction costs, and improve transaction efficiency, enabling global users to easily and securely participate in the Web3 ecosystem.

II. Project highlights

1. Cross-chain interoperability and asset management (UIP)

Unizen's Cross-Chain Interoperability Protocol (UIP) is one of its core highlights, which allows users to easily transfer assets across multiple blockchains without the need for complex bridging tools. By integrating multiple cross-chain service providers including cBridge, Axelar, and LayerZero, Unizen ensures fast transaction speed, low cost, and high security for users. At the same time, the redundancy mechanism of UIP can automatically switch to the best cross-chain service provider to ensure the continuity and security of operations.

2. Unizen Liquidity Allocation Mechanism (ULDM)

ULDM is a unique liquidity allocation system provided by Unizen. Through intelligent liquidity routing and custom transaction splitting algorithms, it greatly optimizes the use of liquidity in decentralized trading. It can scan multiple decentralized exchanges (DEXs) to find the best source of liquidity for users, and by splitting large orders into small transactions for parallel execution, it minimizes slippage, ensures that users complete transactions at the best price, and improves transaction efficiency.

3. Private Market Maker (PMM) Liquidity Integration

Unizen's latest version of ULDM further optimizes the execution of large orders by integrating the liquidity of private market makers (PMMs). ULDM can not only execute trades in the AMM liquidity pool, but also allocate trades to the PMM order book at the same time, ensuring that block trades for deep liquidity trading pairs such as ETH and USDT can be executed at more stable prices, greatly improving trading accuracy and stability.

4. Unified Web3 application operating system

Unizen is not just a trading platform, it provides a complete Web3 operating system that allows users to exchange assets, perform cross-chain operations, and interact with Web3 applications in the same interface. By integrating various Web3 application modules, Unizen provides a unified User Experience, eliminates the complexity of multi-platform operations, makes Web3 interactions simpler and more intuitive, and brings users a highly convenient operating experience.

Unizen provides excellent Web3 ecosystem interaction and asset management solutions through cross-chain interoperability, intelligent liquidity allocation mechanism, and one-stop Web3 application platform, enabling users to participate in the global Web3 ecosystem in a secure, efficient, and convenient environment.

III. Market value expectations

ZCX is the native token of the Unizen platform. As the next generation CeDeFi trading platform, Unizen provides users with one-stop services such as cross-chain asset management, liquidity aggregation, and intelligent transaction routing. With its innovative application in the Web3 ecosystem, Unizen has attracted widespread attention. The initial circulation supply of ZCX token is 691 million, and the total supply is 1 billion. The current circulation market value is about $56,724,750, and the current price of the token is $0.07882.

Considering the potential of Unizen in the field of cross-chain and decentralized finance (DeFi), we can estimate the future price and increase of ZCX token by benchmarking other decentralized finance projects.

Kyber Network (KNC): Kyber Network is a multi-chain cryptocurrency trading and liquidity center with a circulating market capitalization of approximately $86,401,761 and a token price of approximately $0.50.

Assuming the circulating market value of ZCX reaches $86,401,761, the corresponding token price is approximately $0.125.

Expected increase: from the current price of 0.07882 dollars, an increase of about 1.58 times.

Benchmarking Curve (CRV): Curve is a decentralized exchange that focuses on optimizing stablecoins and liquidity pools. Its circulating market value is about $364,072,147, and the token price is $0.30.

Assuming the circulating market value of ZCX reaches $364,072,147, the corresponding token price is approximately $0.527.

Expected increase: from the current price of 0.07882 dollars, an increase of about 6.69 times.

Through these benchmarks, it can be seen that with the growth of ZCX's market value, its price is expected to show significant upward potential. Unizen is driving the market acceptance of its platform through cross-chain interoperability, liquidity management, and the advantages of CeDeFi. The future market value of ZCX is expected to see a significant increase with the expansion of the platform's ecosystem and user growth.

IV. Economic model

Unizen's economic model is driven by its native utility token, ZCX. As the core token of the Unizen platform, ZCX token has multiple functions and ensures the scarcity and value stability of the token through a series of deflationary mechanisms. ZCX is an ERC-20 token based on the Ethereum network, with a total supply of 1 billion and is controlled by various deflationary strategies and distribution mechanisms.

1. Token distribution and linear release mechanism

ZCX's allocation mechanism ensures a stable supply of tokens with different lock-up and release periods.

Private Sale: 16% of the tokens have been distributed in private sales and have been fully circulated since September 2022.

Foundation Tokens: 28.5% allocated to the Foundation, partially circulated, and the remaining portion will be linearly released for 18 months starting from January 1, 2023.

Team Tokens: 20% of the tokens are allocated to the team, and all team tokens are currently locked. 50% of the tokens will be unlocked after the 36-month lock-up period (starting from July 15, 2022) ends, and the remaining part will be linearly released monthly over the next 24 months.

Partners and advisors: 5.5% of the tokens are allocated to partners and advisors, with a lock-up period of 60 months, and will be released linearly on a monthly basis starting from August 1, 2023.

Ecosystem Reserve: 30% is allocated to ecosystem reserve, part of which has been used for burning mechanism and market making, and the remaining 150 million tokens will be controlled by the upcoming Unizen Decentralized Autonomous Protocol (uDAP).

Its token economy model has the following main characteristics:

1. Hyper-deflationary mechanism

Whenever a user conducts a transaction on the Unizen Trade platform or an integrated transaction executed through the Unizen SDK, a portion of the transaction value will be "reserved" for regular burning of ZCX. This burning mechanism is directly linked to the platform's trading volume, with 0.5% of the transaction value reserved for single-chain transactions and 1% reserved for cross-chain transactions. The reserved ZCX tokens will be burned at random times to ensure compliance with regulatory requirements. In addition, Unizen also adopts a secondary repurchase burning mechanism, using the fees integrated with the SDK to repurchase and destroy ZCX tokens, further exacerbating the deflationary nature of the tokens.

2. ZCX Staking and Income (Unizen Earn)

ZCX tokens can be used for the Unizen Earn program. Users can stake ZCX tokens in the program to receive chain-independent rewards provided by the ZenX Labs incubation project. The more ZCX they stake, the higher the reward level they receive, encouraging long-term holding of tokens and injecting more liquidity into the Unizen ecosystem.

3. Professional membership purchase (Pro Membership)

Users can purchase professional membership of the Unizen platform by spending $50 worth of ZCX tokens. Professional members will unlock the platform's advanced transaction functions, and the ZCX tokens paid will be directly sent to the burning address, further enhancing the deflation mechanism of the tokens.

V. Team and financing

The Unizen team consists of over 35 experienced professionals, covering areas such as senior management, internal engineering, and strategic consulting. Team members have deep experience in blockchain software engineering, encryption strategy consulting services, and direct investment. The team members are distributed in Europe and East Asia, with a global perspective and cross-regional market insights.

Unizen's executive team includes the following key members:

- Sean Noga - Chief Executive Officer (CEO), responsible for the strategic direction and overall operational management of the company.

- Martin Granström - Chief Technology Officer (CTO), responsible for the company's technology development and innovation.

- Simon Berglund - Head of Business Development, responsible for market expansion and strategic partnerships.

- Padgett Ong - Architect/Lead Protocol Engineer, specializing in corporate protocol design and blockchain architecture.

In terms of financing, Unizen has distributed 16% of its tokens through private placement sales, and these tokens have been fully circulated since September 2022. In addition, Unizen owns 28.5% of its foundation tokens, which are being gradually unlocked according to an 18-month linear release plan to support the long-term development of the project.

VI. Risk Warning

1. The crypto market itself is highly volatile, and the price of tokens may be influenced by market sentiment, overall economic conditions, and competitor activities, leading to price fluctuations.

2. If the project team is unable to optimize the product or expand the market in a timely manner, it may face the risk of losing market share.

VII. Official link

Website :

https://www.unizen.io/

Twitter:

https://x.com/unizen_io

Telegram:

https://www.t.me/unizen_io

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

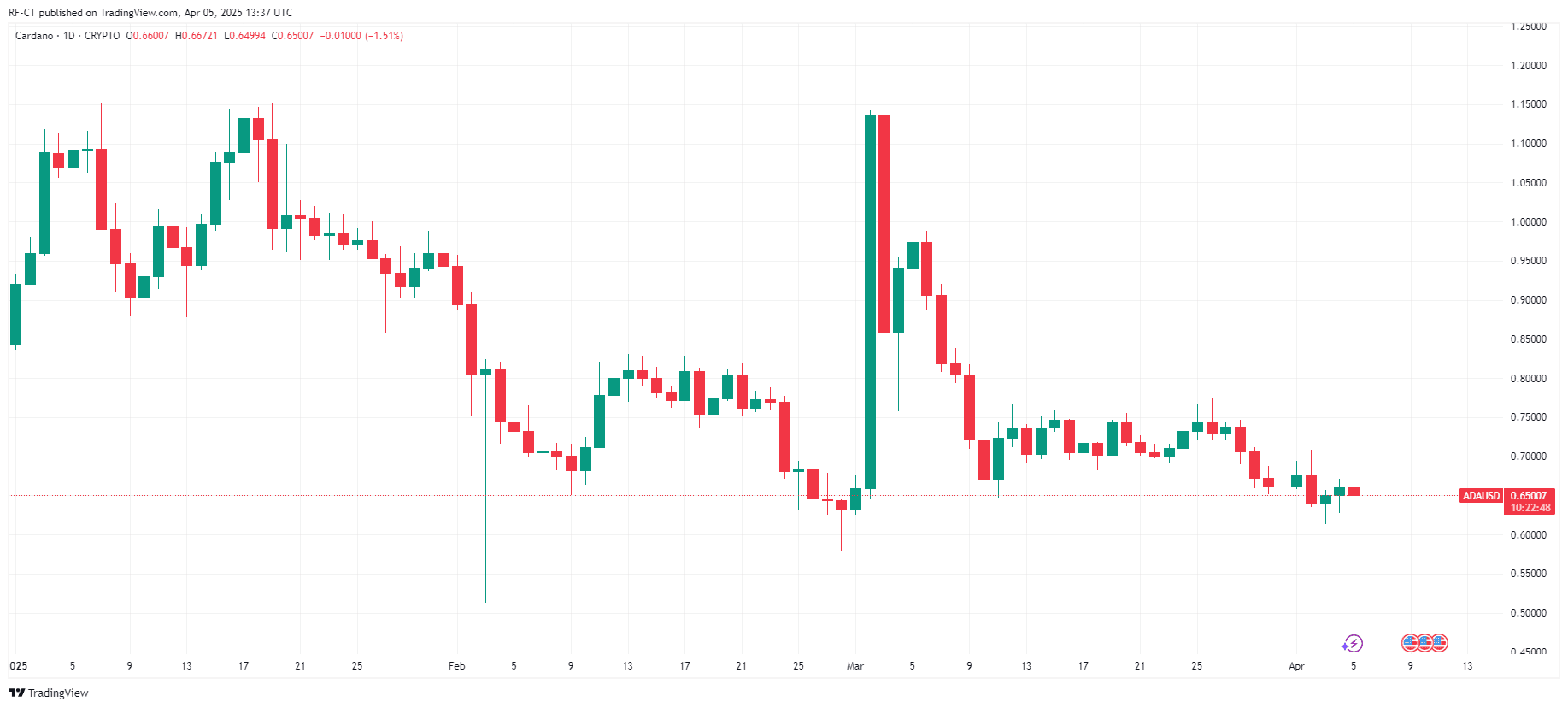

Cardano Price Prediction 2025: Will BTC Integration Push ADA Price to $3 or $5?

Cryptoticker•2025/04/06 02:33

What Is Yield Farming and How Does It Work in DeFi?

Cryptotale•2025/04/06 02:00

Cardano’s ADA First 'Death Cross' in 2025 Fast Approaching: What’s Next?

CryptoNewsNet•2025/04/06 01:11

Polymarket Bettors’ Recession Odds Surge Over 50% Amid Brutal 2 Day Market Decline

As Wall Street tumbles on tariff fears, some online prediction markets share a growing certainty of a recession well before economists reach a consensus.

CryptoNews•2025/04/06 00:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$79,191.49

-4.65%

Ethereum

ETH

$1,622.74

-9.51%

Tether USDt

USDT

$0.9993

-0.03%

XRP

XRP

$1.99

-6.77%

BNB

BNB

$554.47

-6.48%

USDC

USDC

$1

+0.01%

Solana

SOL

$108.19

-8.98%

Dogecoin

DOGE

$0.1523

-9.60%

TRON

TRX

$0.2334

-1.78%

Cardano

ADA

$0.5889

-9.72%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now