Bitget Research: Crypto Market Dominated by Negative Sentiment, Accelerated Decline Sets the Stage for a Major Rally

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effect: USDT-M pools with high annual yield and low risk, and the RWA sector (ONDO, Pendle).

-

Top searched tokens and topics: Penpie, Flux, and AAVE.

-

Potential airdrop opportunities: Major and Soneium.

1. Market Environment

2. Wealth Creation Sectors

2.1 Recommended to Monitor – USDT-M Pools with High Annual Yield and Low Risk

-

Given the current market panic and the unlikelihood of a significant short-term rebound, it is advised to hold a large amount of stablecoins and wait for market stabilization before engaging in right-side trading.

-

Kamino: Currently the lending protocol with the highest TVL on Solana, offering an APY of 13% on USDC and 19% on PYSUD.

-

Aries Markets: Currently the protocol with the highest TVL on Aptos, providing an APY of 10% on USDC and 10.5% on USDT. APT rewards are offered as incentives for both lending and borrowing activities.

2.2 Sectors to Focus on Next – RWA (ONDO and Pendle)

-

The RWA sector continues to draw significant attention within the cryptocurrency industry and is viewed as having substantial potential for market growth. ONDO and PENDLE are leading the RWA sector in government bonds tokenization and crypto asset interest rate swaps, respectively. These segments have a high asset ceiling, and as the volume of managed assets increases, so does the revenue generated by these protocols. Investors should pay special attention to these sectors during market rebounds.

-

Total protocol asset size: The cash flow generated by such protocols primarily depends on the asset size they manage. As asset size increases, revenue rises, which should lead to strong performance in their respective token prices.

-

Policy impact: As the cryptocurrency industry gradually gains legislative approval and societal acceptance, favorable policies for this sector will also become a major factor driving the rise in token prices. With more asset management giants entering this field, we anticipate steady progress in its development.

3. Top Searches

3.1 Popular DApps

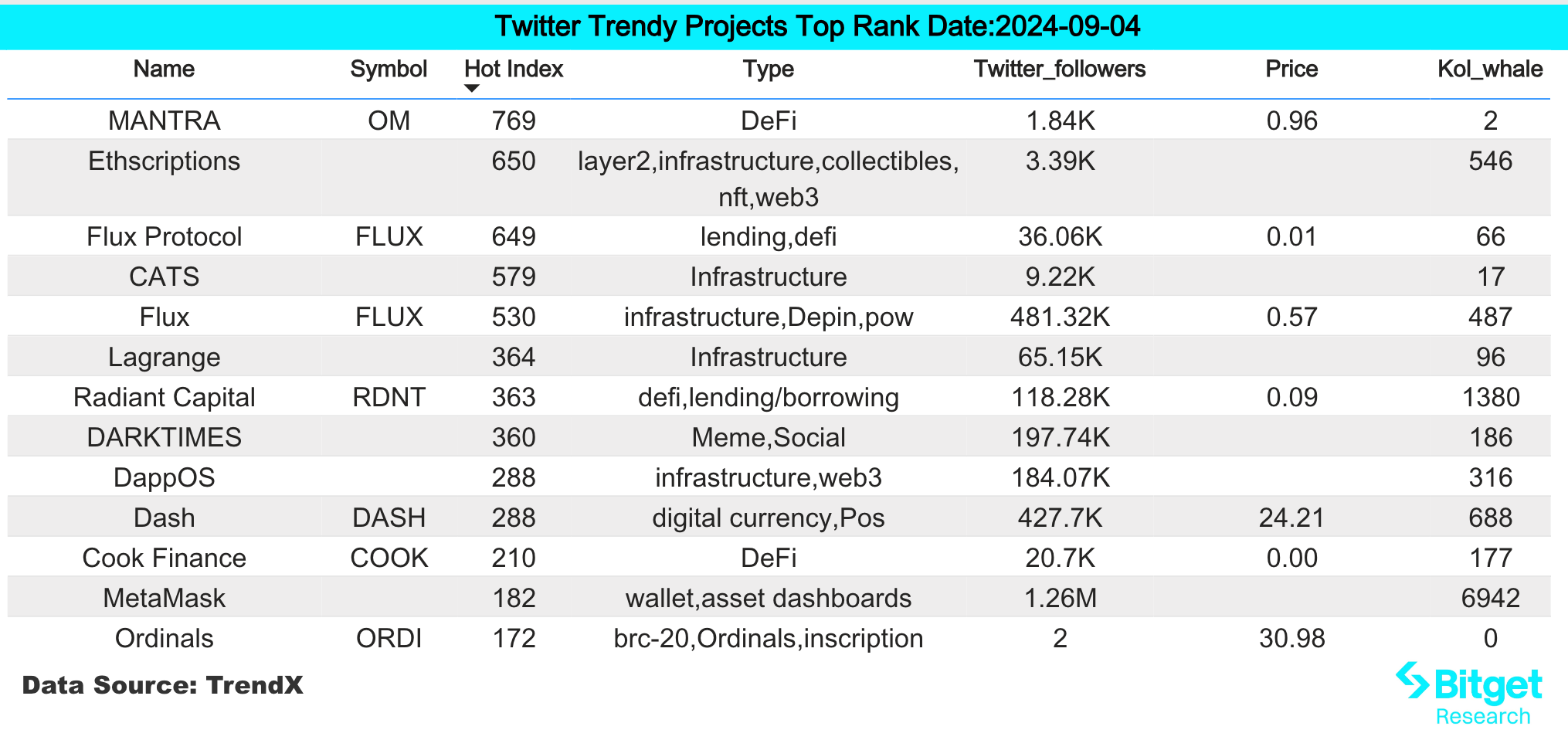

3.2 X (former Twitter)

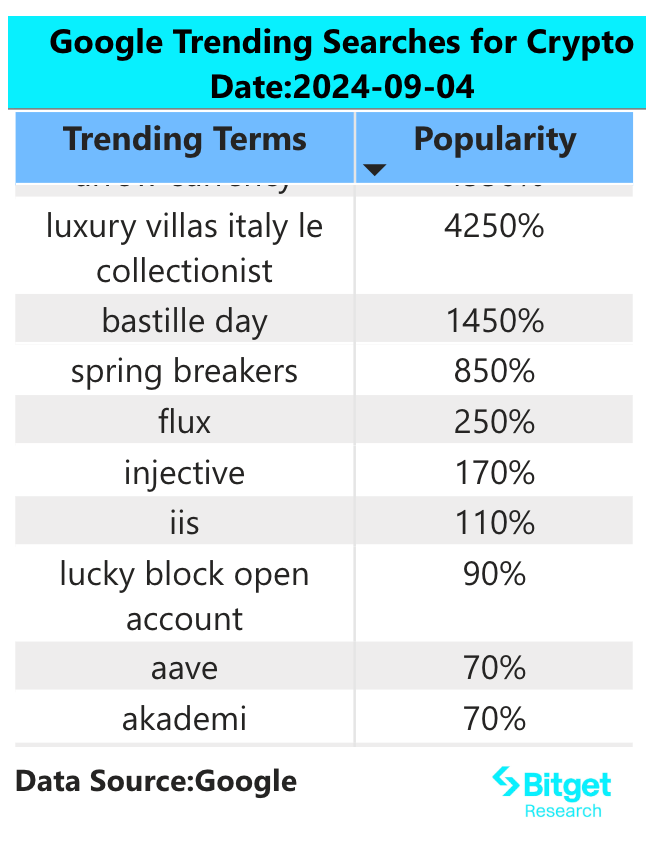

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Banking the unbanked, but this time for real?

Ripple and SEC made a $50 million deal

Altcoins Gear Up for Profitable Rally

Altcoin holders could be in for major gains as market sentiment turns bullish.Altcoin Holders Anticipate Major GainsWhat’s Fueling the Altcoin Rally?Time to Watch the Altcoin Market Closely

Best Cryptos to Buy Now: Why Qubetics, Cardano, and Toncoin Are Dominating 2025’s Blockchain Revolution

Explore why Qubetics, Cardano, and Toncoin are the best cryptos to buy now in 2025, with groundbreaking innovations and real-world applications.Qubetics ($TICS): Bridging Real-World Assets with BlockchainCardano (ADA): Pioneering Sustainable Blockchain SolutionsToncoin (TON): Revolutionizing Digital InteractionsUnderstanding Real World Asset TokenizationConclusion