Short Selling Solana Meme Coins Can Wipe You Out: Here Are The Risks

- Dumpy.fun becomes the first platform for shorting Solana meme coins.

- There are significant risks with short-selling any asset.

- Risks also extend to lenders on the platform.

Meme coins are among the most volatile assets in crypto, driven mostly by hype. Their prices fluctuate wildly, going up and down much more than other tokens. So far, however, traders were only able to bet on each coin going up.

Sponsored

Most recently, Save Finance, formerly known as Solend, introduced a platform that enables traders to bet against these tokens. Dumpy.fun, styled after the popular Pump.fun, enables traders to short meme coins and profit when prices begin to drop. However, this strategy comes with significant risks, even higher than traditional meme coin trading.

Dumpy.fun lets Traders Profit from Declining Meme Coins

Short selling is coming to Solana meme coins, giving new profit potential that also comes with an element of risk. On Tuesday, July 30, Save Finance, formerly Solend, launched Dumpy.fun beta , a platform for short selling meme coins. The platform allows users to profit from a decline in value of a token.

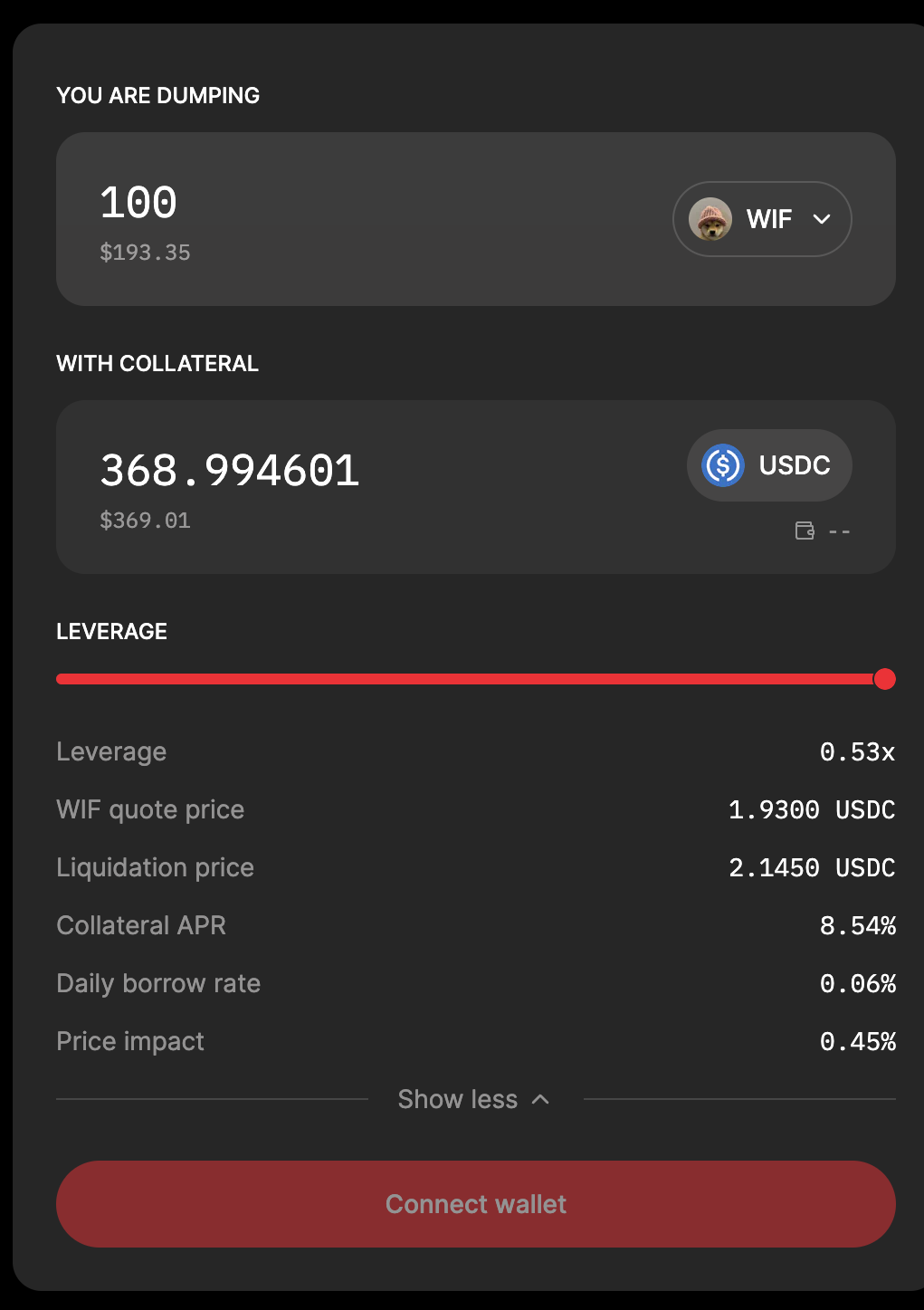

Source: Dumpy.fun

Source: Dumpy.fun

The platform is straightforward to use. Users first have to select the token to short and the short amount. Then, they post collateral equal to the 200% of the short position. The platform will then reveal the terms , allowing users to connect their wallet and select a trade.

The platform borrows the meme coin using the deposited collateral and sells it immediately at the current market price. If the price of a token goes down, traders can buy them and return the amount to the lender, at a profit. However, if the price of the token goes up, traders can quickly face liquidation.

Risks of Shorting Meme Coins on Dumpy.fun

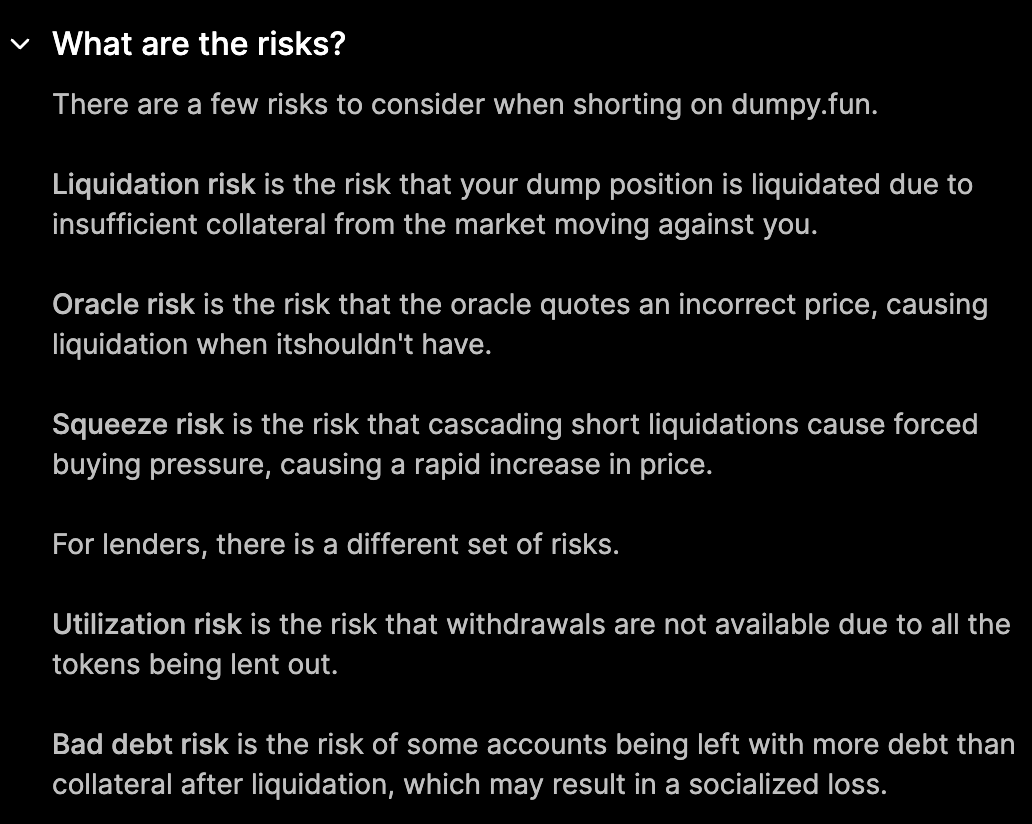

Liquidation risk is the most immediate risk facing short selling traders. This happens when the token goes up in value enough so that it makes the collateral insufficient to cover the trade. If the trader fails to provide additional collateral, the position is liquidated, leading to a total loss of the initial collateral.

Source: Dumpy.fun

Source: Dumpy.fun

For example, if a trader buys WIF at 1.93 USDC per coin, it only takes WIF to increase to 2.145 USDC, before they face a margin call. Failing to provide more collateral, the position is liquidated, leading a loss of the collateral.

Sponsored

This can be risky, as meme coins are notoriously volatile. Even if a token trends downward in the medium run, a brief upward can wipe out the short sellers. What’s more, this high volatility can introduce the squeeze risk, which refers to cascading liquidations that can result in significant losses for short sellers.

Risks for Lenders on Platforms like Dumpy.fun

Short sellers are not the only parties exposed to risk. The most important of these is the bad debt risk. Traders need to be aware that they take on the risk of liquidations that leave behind more debt than the collateral can cover.

Losses like these are distributed among all lenders on the platform.

This leads to losses for all the lenders, and if enough liquidations like these happen, losses can be substantial.

Lenders have to think about utilization risk, which occurs when all the tokens are lent out, and withdrawals are temporarily unavailable.

In addition to these risks, both lenders and short sellers need to be aware of the oracle risk, caused by faulty price oracles.

On the Flipside

- Short selling is risky. It’s important for short sellers to only put up collateral in the amount they can lose.

- Lenders should know that they are also exposed to risk, which could amount to the total loss of their capital.

Why This Matters

Understanding the risks of shorting meme coins on platforms like Dumpy.fun is essential for both traders and lenders in the volatile crypto market. Knowing these risks can help traders manage their collateral more effectively and avoid substantial losses.

Read more about the meme coin volatility:

Meme coins Have Increased the Impact of Market Corrections This Cycle

Read more about Solana ETF prospects:

SEC Concedes on Solana, But a SOL ETF Isn’t Any More Likely: Here’s Why

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stocks, cryptocurrencies surge on tariff reversal

Dow and S&P 500 post intraday gains we haven’t seen since 2020 following news that Trump will pause tariffs

Chainlink Drops Below Key Trendline: Support Levels Tested at $10 and $7.50

The onshore RMB fell to 7.3518 against the U.S. dollar, hitting a new low since December 26, 2007.

Agency: Trump's tariff policy shift is positive, but uncertainty remains