Market research and analysis of Telcoin (TEL), a rising star in the payment track

Bitget2024/06/14 07:05

By:0xCarlos

I. Project introduction

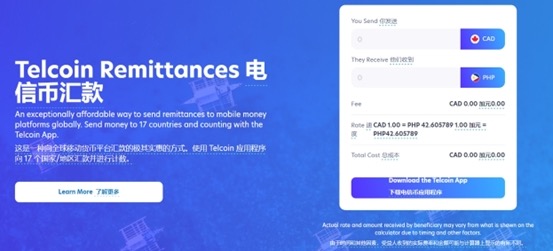

Telcoin (TEL) is a mobile remittance network built on Ethereum, aimed at providing Financial Services through mobile networks, especially cross-border remittances and mobile payments. Telcoin's vision is to use the infrastructure of telecommunications operators to provide convenient, secure, and low-cost Financial Services to global users.

II. Project highlights

1. Business rigid demand, conducive to solving user pain points

Currently, the global cross-border remittance market is huge and is expected to continue to grow in the future. Traditional cross-border remittance services are usually expensive and slow, especially in developing countries. User Experience is poor and there are many inconveniences in actual use. Telcoin hopes to become a leader in the decentralized remittance field by combining blockchain and mobile communication companies to provide users with convenient and low-cost Financial Services.

In other words, Telcoin will allow for fast and low-cost payments without intermediaries.

2. Transparent and convenient transactions

Telcoin utilizes the Ethereum blockchain to ensure transparency and security of transactions. By collaborating with mobile operators, it maximizes coverage of users in need. Compared to traditional remittance services, Telcoin offers lower transaction fees and faster transaction speeds, giving it market advantages.

3. Wide range of partners

Telcoin has established partnerships with several telecom operators and Financial Institutions, such as GCash and ECPay, which will benefit the market expansion of TEL.

III. Economic model

The TEL token has practical application scenarios. When users use the Telcoin platform for cross-border remittances, they need to use the TEL token to pay for transaction procedures, and also provide incentives for partners and users to promote the development of the platform ecosystem.

The total supply of Telcoin (TEL) is fixed at 100,000,000,000 tokens. Its initial coin publishing (ICO) took place between December 2017 and February 2018.

TEL allocation is as follows:

-50% is allocated to mobile operators as a reward.

-25% is used for the first sale to investors.

-15% reserved for the project team.

-5% is committed to community development.

-5% is reserved for working capital.

Team and financing

Telcoin's team is composed of experienced blockchain technology experts, fintech experts, and senior professionals in the telecommunications industry.

Paul Neuner has over 20 years of experience in the telecom industry as CEO, having founded Mobilium and Ikou before Telcoin.

The COO of the project, Claude Eguienta, is a technical expert with rich experience in blockchain and distributed system development. Before joining Telcoin, he worked for multiple startups and large enterprises, responsible for technology development and project management.

Telcoin not only completed its ICO and raised funds in 2017, but also raised a total of $10 million in seed financing. This round of financing was conducted on May 7, 2021, involving multiple investors, including Chronos Ventures, CRT Labs, CCK Ventures and other institutions.

V. Market value expectations

Tel's current market value 230 million US dollars, as a cooperation with mobile operators, the market demand for business is strong, and the token has the actual consumption scene of the landing project, this market value is just the beginning of the sea of stars, compared with the same track leader XRP 26 billion + US dollar market value, and the same as the blockchain cross-border transfer XLM 2.80 billion + US dollar market value, TEL subsequent rise space is expected to exceed 1000%.

VI. Risk Warning

1. The security and stability of blockchain technology remains one of the main risks, and any technical vulnerability could have a significant impact on the platform.

2. The remittance market is fiercely competitive with established companies such as Western Union and newer fintech solutions. Telcoin needs to constantly innovate to maintain its leading position.

VII. Official link

Website:

https://www.telco.in/

Twitter:

https://x.com/telcoin

Telegram:

https://t.me/telcoincommunity

Note: This article is written by a user of the TEL community and is for information sharing only. It does not constitute any investment advice.

0

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Pyth Network (PYTH) To Rise Further? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe•2025/04/26 07:55

Sonic (S) To Continue Rebound? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe•2025/04/26 07:55

LUNC Bulls Take Charge: Technicals Point to a Major Reversal and Moonshot Target

Cryptonewsland•2025/04/26 06:22

Dogwifhat (WIF) price jumps 60% as meme coin market rebounds, but pullback signs appear

Coinjournal•2025/04/26 02:22

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,062.2

-0.46%

Ethereum

ETH

$1,789.15

+1.04%

Tether USDt

USDT

$1

+0.01%

XRP

XRP

$2.19

+0.24%

BNB

BNB

$603.03

-0.04%

Solana

SOL

$148.85

-3.14%

USDC

USDC

$0.9999

-0.01%

Dogecoin

DOGE

$0.1811

+0.09%

Cardano

ADA

$0.7037

-1.08%

TRON

TRX

$0.2500

+2.89%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now