AI tsunami strikes again, taking stock of 10 AI altcoins worth watching.

In May, the AI industry's tsunami may revive the market for AI concept altcoins.

Author: Golem, Odaily Planet Daily

In May, the AI tsunami is coming again. OpenAI will release a multimodal AI model capable of dialogue and object recognition on May 14 at 1 a.m. (UTC+8). Google will showcase the latest AI tools and product enhancements at the Google I/O conference on May 15 at 1 a.m. (UTC+8). Microsoft will also focus on AI topics at the Build annual developer conference on May 21.

AI is the most popular narrative in various fields in 2024 and will have a chain reaction. As early as February, when OpenAI launched the text-to-video model Sora, various AI concept altcoins experienced a surge. The AI tsunami in the tech industry in May may also trigger a rise in altcoins related to AI in the crypto industry.

Odaily Planet Daily will list 10 undervalued AI concept altcoins in this article for reference.

PALM (PaLM AI)

Concept: PALM AI is a second-generation AI solution supported by Google's AI toolkit and internal innovative algorithms. The project focuses on developing on-chain AI integration tools and real-world AI applications. It also provides customized AI robot solutions to meet the different needs of individuals, groups, enterprises, and projects. PALM is the utility token of PaLM AI, and holding PALM allows participation in the platform's revenue sharing.

Market Cap: $73 million

GLQ (GraphLinq Chain)

Concept: GraphLinq is a no-code automation platform on the blockchain, consisting of GraphLinq Chain and GraphLinq Protocol. It aims to enable users to deploy and manage various automation processes easily without programming skills through IDE, App, Engine, and Market components. It also provides built-in AI to help build dApps. Completed a strategic round of financing on March 15 with investment from DWF Labs, specific amount undisclosed. GLQ is the native token of GraphLinq Chain used to pay gas fees on the network.

Market Cap: $31 million

VMINT (VoluMint)

Concept: VoluMint is an AI automated market maker that seamlessly integrates with CEX and DEX, offering fully customizable market-making solutions to support crypto projects. Its market-making solutions include barrier-free market-making bots, AI automated trading bots, decentralized and unpredictable trading patterns. VMINT is the utility token of VoluMint, and a certain percentage of VoluMint's income will be distributed to those staking tokens. Token holders can also participate in project governance through voting.

Market Cap: $14 million

NAVI (Atlas Navi)

Concept: Atlas Navi is a navigation app that uses AI and smartphone cameras to detect road conditions, accidents, traffic in each lane, available parking spaces, police cars, etc., to help users find the fastest route to their destination. Through the Drive to Earn economic model, users earn NAVI tokens as rewards for using the navigation. Atlas Navi received a $1.2 million grant from the EU in 2019 for its technical development.

Market Cap: $11 million

(ChainGPT)

Concept: ChainGPT is a developer of AI solutions in the Web3 space, building various tools for users by integrating large language models (LLMs) with blockchain. These tools include AI chatbots, AI NFT generators, AI news aggregators, AI trading assistants, automated smart contract generation and auditing, etc. CGPT is the utility token of ChainGPT, and holders have rights to participate in DAO voting, staking, free access to AI tools, airdrops, etc.

Market Cap: $110 million

AI (Sleepless AI)

Concept: Sleepless AI is an AI-based virtual companion game that uses AIGC and LLM to create rich story-based gameplay and interactive character development. The project is currently developing three games, with the first game being HIM, a virtual boyfriend Otome game, which has been officially approved for listing on the App Store in 150+ countries worldwide.

Market Cap: $153 million

GPU (Node AI)

Concept: Node AI is a decentralized platform that provides GPU and AI resource rentals. Users can stake GPUs to receive profit sharing and also access services like AI node leasing and GPU computing power lending.

Market Cap: $121 million

ENQAI (enqAI)

Concept: enqAI is a decentralized AI model network supported entirely by a decentralized GPU node network. This allows enqAI to make its models free from political and cultural biases and censorship resistance. ENQAI is the token reward distributed to nodes supporting enqAI.

Market Cap: $48.6 million

EMC (Edge Matrix Computing)

Concept: EMC (Edge Matrix Computing) is a decentralized AI computing power application network and a project based on the Depin+AI concept. EMC directly connects GPU computing assets with AI applications and provides them to ordinary developers and users in a low-cost and convenient manner. EMC has completed two rounds of financing with lead investments from Faculty Group and Flow Ventures, amount undisclosed.

Market Cap: $30 million

AQTIS (AQTIS)

Concept: AQTIS is an intelligent liquidity protocol supported by Quant-Tech and AI. Liquidity is provided by dApps built on AQTIS, aiming to enable ordinary users to use institutional-grade investment strategies for stable returns and advanced trading.

Market Cap: $12.6 million

Summary

Looking at the historical cycles of the crypto industry, bull markets generally last around 1.5 years after halving, while the altcoin season will start within a few weeks after halving. The AI concept is undoubtedly one of the most worthwhile narratives to speculate on, combined with hot news in the tech industry, it is worth preparing in advance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

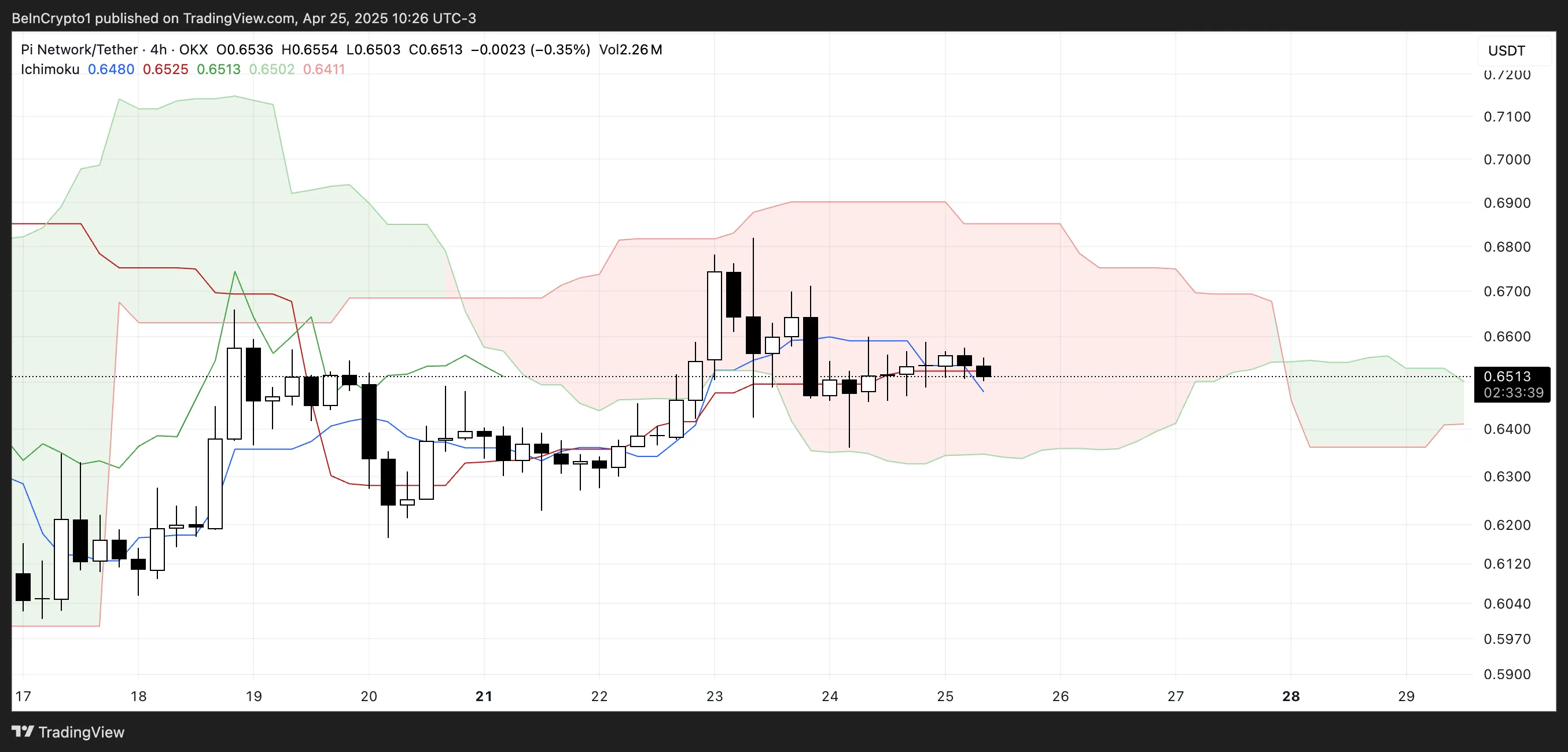

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns