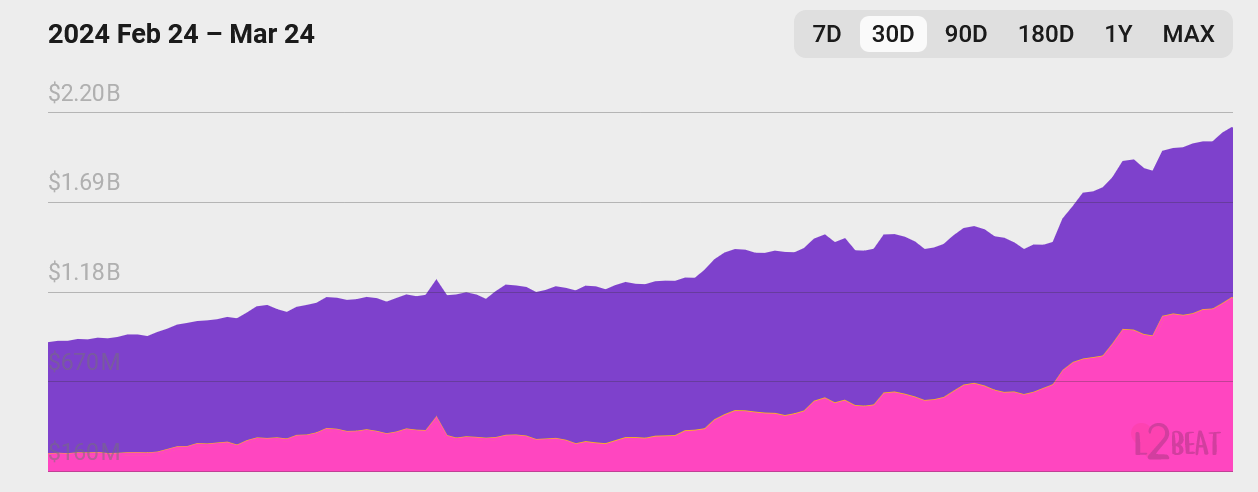

Base TVL doubles in a month as pundits tip memecoins to drive adoption

Futures Market Updates

Bitcoin Futures Updates

Ether Futures Updates

Top 3 OI Surges

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gitcoin’s Strategic Shift: Embracing a New Era with Focused Goals

In Brief Gitcoin shuts down Gitcoin Labs due to financial burdens. Focus shifts to strengthening the Gitcoin Grants program for future sustainability. Funding for the Gitcoin Grants Program is secured until approximately 2029.

Solana Sets Sights on Dominating Ethereum with Strong Performance

In Brief Solana shows strong potential for outperforming Ethereum in the near term. Analysts highlight critical support levels for both Solana and Ethereum. Traders should remain cautious amidst market volatility while seizing potential opportunities.

PEPE Coin’s Promising Path to Recovery Captivates Enthusiasts

In Brief PEPE coin shows signs of recovery similar to Dogecoin and Shiba Inu. Analysts predict potential price doubling for PEPE in the near term. Bitcoin's stability supports altcoin confidence amidst market volatility.

Cardano Empowers Users with XRP Transactions via Lace Wallet

In Brief Cardano users can now perform XRP transactions through Lace Wallet. The Midnight Network is introducing new airdrop opportunities for XRP holders. Market reactions indicate cautious optimism for Cardano and XRP prices.