Introducing MetaMorpho: Permissionless lending vaults on Morpho Blue

One week ago, we announced Morpho Blue . Today, we unveil MetaMorpho, a protocol that advances our vision for DeFi that is built in layers, like the internet.

MetaMorpho is a protocol for permissionless lending vaults built on top of the Morpho Blue protocol.

Why MetaMorpho

Today, current lending platforms force users into a one-size-fits-all risk profile. This approach fails to address the diverse needs of users and tends to overexpose them to long-tail risk. Morpho Blue solves this by externalizing risk management and allowing for unlimited risk profiles.

However, depositing funds directly to Morpho Blue can be complex for users. They must consider onchain and offchain market conditions to choose collateral assets, liquidation LTV, oracles, and caps. Many users need a way to delegate their funds’ management to risk experts like they are used to with Aave or Compound.

What is MetaMorpho

MetaMorpho is an open-source (GPL) protocol to build any lending experience with optimized rates and transparent risk curation on top of Morpho Blue. A MetaMorpho vault accepts passive capital and deposits it on Morpho Blue markets. Liquidity is rebalanced across markets to manage risk and optimize returns.

MetaMorpho simplifies lending by allowing users to delegate risk management to risk experts curating the vaults, as it is done on Aave or Compound.

Each MetaMorpho vault can cater to users with diverse risk profiles by depositing into markets with different collateral assets and with different parameters.

In other words, MetaMorpho enables the creation of any lending experience, such as Aave, Compound, Spark, Flux, and all their forks, on top of one trustless and efficient primitive: Morpho Blue.

Finally, the liquidity from each MetaMorpho vault is shared on Morpho Blue markets to the extent their allocations overlap. This shared liquidity provides excellent network effects for the Morpho ecosystem at scale.

A better way to earn interest in DeFi

Users can deposit assets in a MetaMorpho vault and earn passive yield from overcollateralized lending on Morpho Blue. MetaMorpho vaults provide:

-

Curated Risk: Each vault caters to a different risk profile, ending the one-size-fits-all approach.

-

Better Yield: Dynamic rebalancing across Morpho Blue's capital-efficient markets improves returns.

-

Transparent: Noncustodial with immutable logic and verifiable allocations.

Incentive-compatible risk management

DAO-based risk management in lending pools has its flaws , but MetaMorpho paves the way for a new approach:

-

Service users, not token holders: With their MetaMorpho vault, risk protocols, and experts now serve users directly instead of consulting for DAOs. This approach is a more scalable business model that is better aligned with users.

-

Open Competition: Creating and curating a MetaMorpho vault is permissionless. This will lower barriers to entry and encourage actors to provide more effective and transparent services at a lower cost.

Technical Overview

MetaMorphoFactory is a permissionless and immutable factory contract deploying ERC-4626 -compliant MetaMorpho vaults.

Each vault has a dedicated loan asset and can deposit funds in up to 30 different Morpho Blue markets with various collateral, Liquidation LTV, and oracles.

Each market has a supply cap configured onchain that guarantees maximum exposure to a specific market. More information on the allocation of liquidity, roles, and rewards management is available in the repository . The audit of the contracts will start in the coming days. If you are a security researcher, feel free to contact Merlin .

What’s next?

We can’t wait to see all the diverse lending experiences that MetaMorpho will enable. The protocol will democratize risk management and encourage healthy competition to reduce costs and foster open innovation.

The Morpho team is already working with a number of best-in-class risk experts and protocols in the space to release different MetaMorpho vaults for the launch. Keep an eye out for further announcements on this front!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

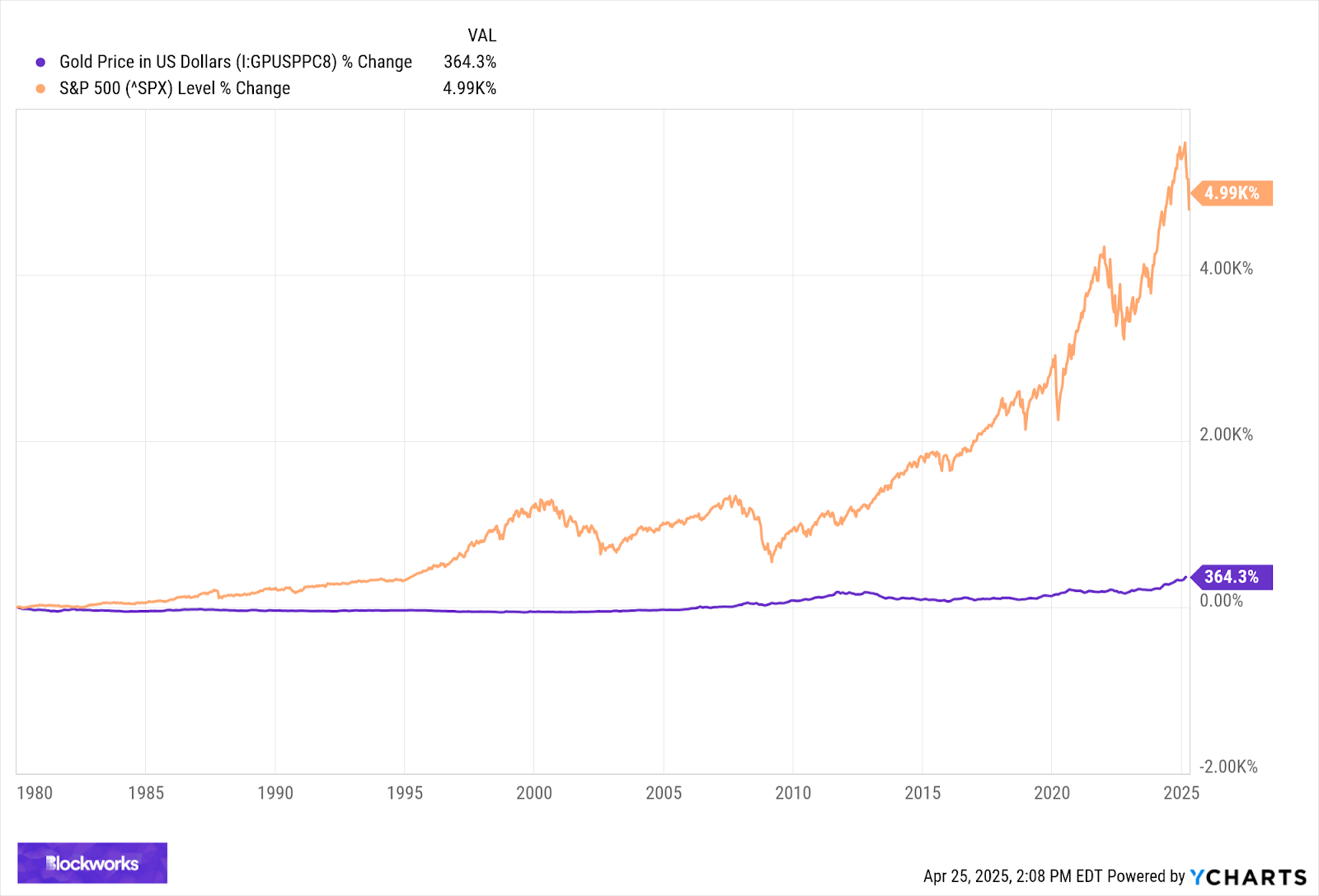

Friday charts: The Marvin Minsky moment is here

Have markets been obsessing over the wrong Minsky?

Charles Hoskinson Reveals Exciting Plans for Lace Wallet’s XRP Functionality

In Brief Charles Hoskinson announces XRP functionality for Lace wallet. Integration aims to enhance multi-chain support and user experience. Upcoming NIGHT token distribution includes XRP holders.

Meme project BONK launches Meme coin issuance platform Letsbonk.Fun