First Mover Americas: Crypto AI Tokens Rally After Musk Unveils New Company

The latest price moves in crypto markets in context for July 13, 2023.

This article originally appeared in , CoinDesk’s daily newsletter putting the latest moves in crypto markets in context..

Artificial intelligence (AI) related crypto tokens posted gains after Tesla and SpaceX CEO Elon Musk on unveiled a new AI company called xAI as an alternative to popular chatbot ChatGPT. SingularityNET (AGIX) rose 11% over the past 24-hours, while Fetch.ai (FET) climbed about 7% over the same time period. The team will be led by Musk and includes members that have previously worked at DeepMind, OpenAI, Google Research, Microsoft Research, Tesla, and the University of Toronto, according to the company website. The newly formed company will be a separate entity from Musk's X Corp., but xAI said it will work closely with his other companies. xAI will host Twitter Spaces chat on Friday, July 14th.

Merchants on messaging app Telegram are now able to accept payments in cryptocurrency as services provider Wallet expands beyond its chat-centric payments mechanism.Wallet, which is built on The Open Network (TON) blockchain, already . Now it's letting merchants integrate cryptocurrency into the bots they use to accept payments, it said in an emailed announcement on Thursday. The system allows for payment for goods and services using tether (USDT), bitcoin (BTC) and toncoin (TON).

A group of Polygon founders and researchers proposed a token that would replace the network's MATIC token with POL. The move would allow POL to function as a single token for all Polygon-based networks, including the main Polygon blockchain, the Polygon zkEVM network, and various supernets – application-specific blockchains that run atop the main Polygon network. The proposal lifted MATIC as much as 2.6% to $0.747 in the first three minutes after the announcement. If the proposal is accepted, network validators will be able to support the operation of multiple chains using a single token.

- Omkar Godbole

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

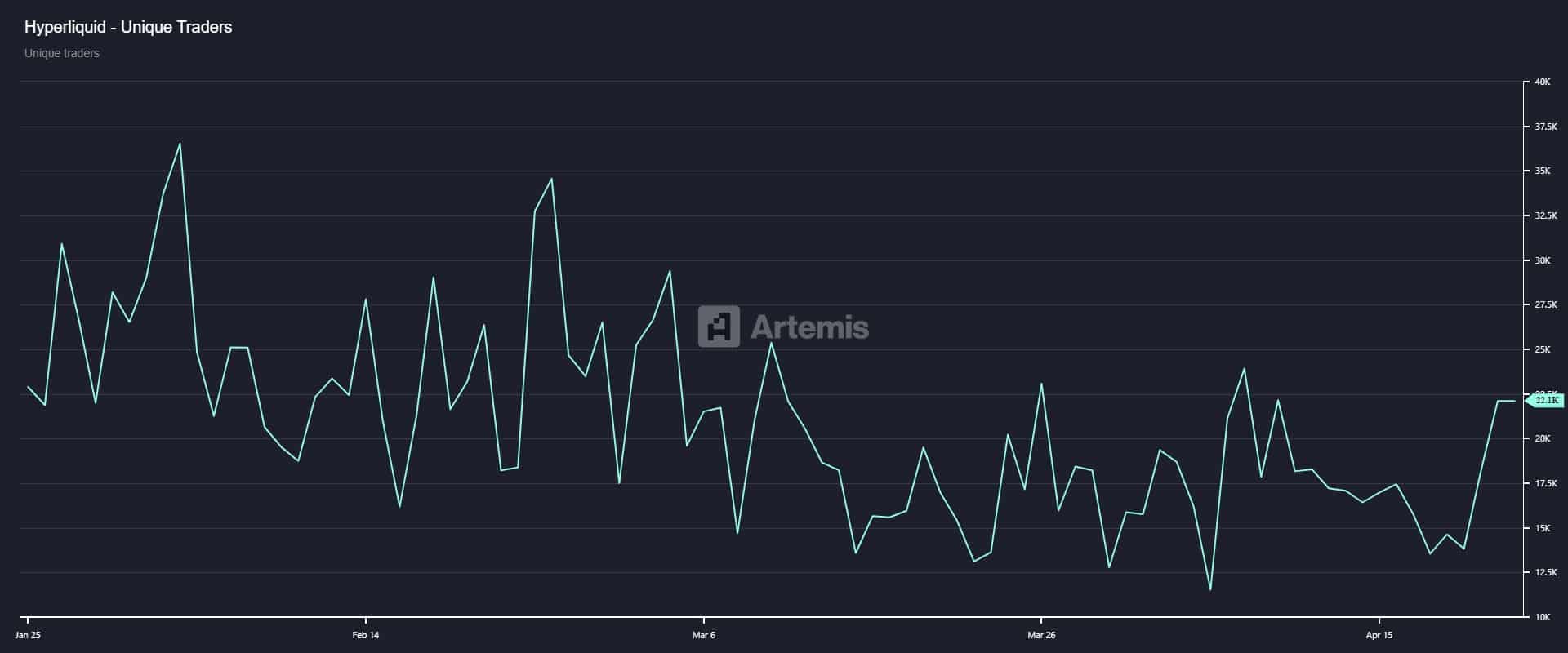

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.