First Mover Americas: Bitcoin Traders Await Fed Decision

The latest price moves in crypto markets in context for June 14, 2023.

This article originally appeared in , CoinDesk’s daily newsletter putting the latest moves in crypto markets in context..

Bitcoin () traders are taking a stance ahead of Wednesday's meeting of U.S. Federal Reserve’s Federal Open Market Commitee (FOMC) meeting, with most expecting a, i.e., the central bank leaving interest rates unchanged while keeping the door open for future increases. The Fed is set to announce its interest rate decision on Wednesday at 2 p.m. ET (18:00 UTC). Puts – or bearish bets – tied to bitcoin are trading pricier than bullish calls heading into the Fed meeting, according to options risk reversals data tracked by Singapore-based crypto trading giant QCP Capital. Traders often consider put bias as showing a nervous mood in the market. Bitcoin is little-changed over the past 24 hours at around $25,900. Top performers amongst digital assets on Wednesday were Binance’s BNB token, which gained 5%, and Chainlink (LINK) which was up almost 3% on the day.

The federal judge overseeing the U.S. Securities and Exchange Commission's (SEC) against Binance and declined to approve a temporary restraining order freezing the U.S. trading platform's assets. The decision allows to continue doing business while hashing out restrictions with the regulator. If the two sides can agree on limits, Judge Amy Berman Jackson of the D.C. District Court said “there’s absolutely no need” for a restraining order. In the meantime, the judge ordered to provide a list of its business expenses to the court, and ordered the parties to continue negotiating. A status update is due by close of business Thursday.

Bitcoin on crypto exchanges has slipped to its lowest levels since February 2018, data from on-chain analytics firm Santiment shows. The decline has been particularly considerable since the SEC’s lawsuits against Coinbase and Binance earlier this month, with 6.4% of supply leaving exchanges in the past week. Supply has been steadily falling since 2020, when it peaked in the depths of the then-bear market, the data shows. This action suggests traders and investors have been continually taking their bitcoin off exchanges in favor of self-custody, said Santiment.

Chart of The Day

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

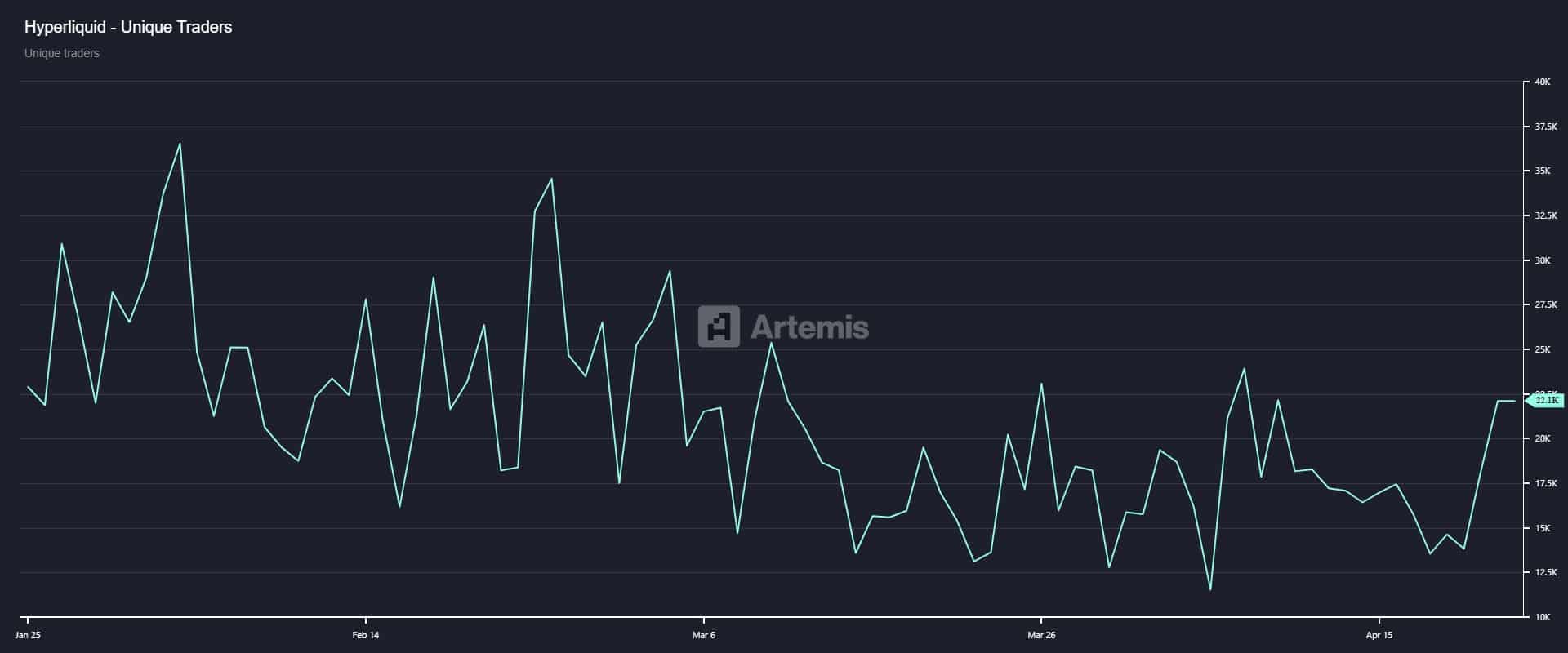

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.