Bitcoin Jumps Past $25.7K After BlackRock iShares ETF Filing

The largest cryptocurrency rose more than 1.3% in the hour after the announcement.

Bitcoin jumped past $25.700, a more than 1.3% gain, in the hour after the iShares unit of fund management powerhouse BlackRock (BLK) filed paperwork Thursday afternoon with the U.S. Securities and Exchange Commission (SEC) of a spot bitcoin () ETF.

Bitcoin dipped below $25,000 just a day earlier for the first time in three months and spent most of Thursday prior to the BlackRock announcement hovering just over that threshold. BTC's price sank amid concerns about U.S. central bank hawkishness and increasing U.S. regulatory scrutiny of the crypto industry.

But the BlackRock announcement rekindled optimism about the possibility of a spot bitcoin ETF, even after the SEC has rejected multiple applications over the past 18 months.

To be named the iShares Bitcoin Trust, the fund's assets are to "consist primarily of bitcoin held by a custodian on behalf of the Trust," according to the filing. That custodian will by crypto exchange Coinbase (COIN), said the filing.

CoinDesk reported on BlackRock's intention to soon file for a bitcoin ETF.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

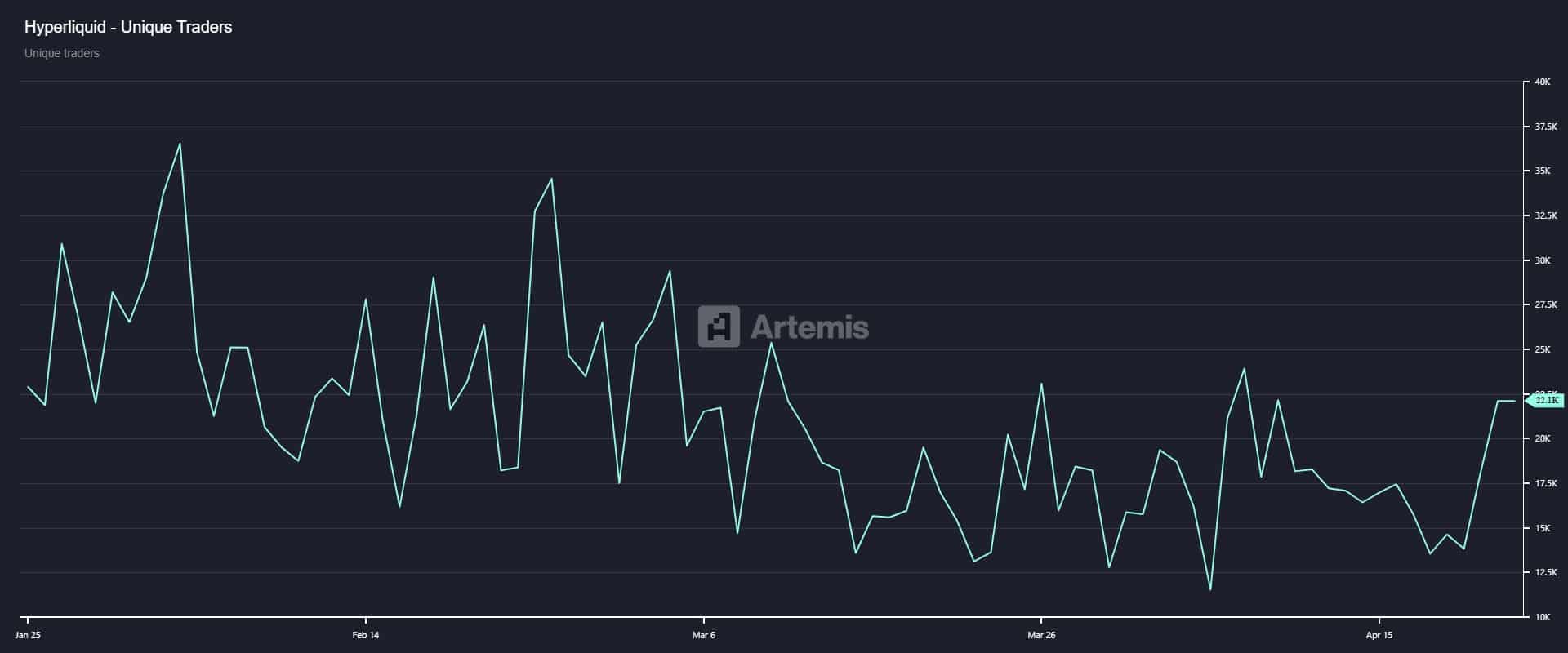

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.