Meme Coin BOB Tanks 45% After Elon Musk Calls its Twitter Bot Account a 'Scam'

Musk had previously engaged with the Bob token bot several times, aiding a value rise.

Prices of meme coin bob (BOB) slid as much as 45% on Sunday as its popular automated Twitter bot was suspended after the social media giant's owner Elon Musk called the account a “scam."

Twitter even suspended another automated bot called @AskTheWassie, a comic frog that operated similarly to @ExplainThisBob on Sunday.

“Promotion of scams under the guise of being a funny/helpful bot will result in suspension. Doesn’t matter how much you pay us,” Musk tweeted.

Data shows BOB prices quickly fell from $0.000031 to $0.000016 on Sunday as traders likely reacted to Twitter’s actions, reaching a market capitalization of $13 million. As such, the tokens have been in a nearly continuous slide since early May, when they reached a peak capitalization of $74 million.

The automated @ExplainThisBob account quickly went viral on Twitter in late April for its witty summaries and comedic responses to tweets. Musk once replied “I love bob” to an @ExplainThisBob in April, aiding a quick price surge at the time.

Musk has since engaged several times with the Bob bot. He tweeted as recently as June that “Once again, Bob nails it,” in response to a political discussion.

However, Musk said last week that Twitter would crack down and suspend accounts that seemed to “game its verification system” and “self-promote or advertise in a misleading way.”

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

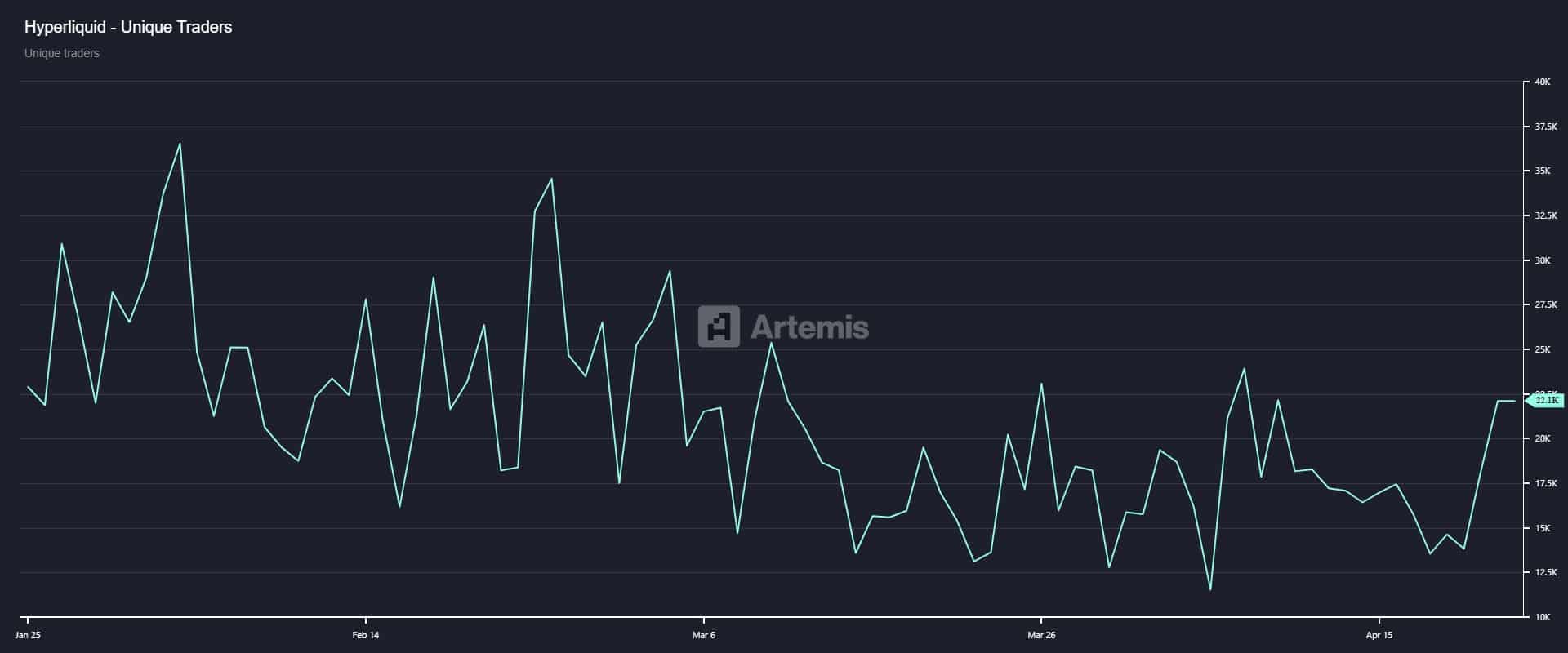

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.