Bitcoin's Price Bump to $30K Sees Short Traders Nurse Biggest Loss in 2 Months

“Bitcoin’s rally is part of a larger trend signaling a shift towards bitcoin as a distinctly strong and established store of value,” one investor said.

Short traders took on the biggest single-day losses since April as over $178 million worth of bets against crypto tokens were liquidated in the past 24 hours, shows.

The total liquidations - including longs and shorts - exceeded $203 million, with bitcoin (BTC) futures racking up $75 million in losses followed by ether (ETH) futures at $51 million. Pepecoin (PEPE) futures saw the highest losses among altcoins at just under $10 million.

Shorts are bets against price rises, while longs refer to bets on price increases for any financial asset. Crypto exchange Binance recorded the most losses among its counterparts at $65 million, followed by OKX at $58 million.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Large liquidations can signal the local top or bottom of a steep price move – which may allow traders to position themselves accordingly.

Bitcoin touched the $30,000 level for the second time this year following a flurry of ETF filings in the U.S. – which may have buoyed a bullish outlook among traders. This likely fueled a rally among major tokens, with cardano's ADA, Solana’s SOL and dogecoin (DOGE) posting weekly gains of at least 18%.

Bitcoin’s sudden price bumps have also led to options traders betting on even higher prices, . Such sentiment is a near 180-turn from the start of June, when bullish hopes were dented following regulatory action in the U.S. against crypto exchanges Binance and Coinbase.

Some market observers say the trend is likely to continue should ETF applications from traditional finance giants such as BlackRock be approved in the coming months.

“Bitcoin’s rally is part of a larger trend signaling a shift towards bitcoin as a distinctly strong and established store of value,” shared Alex Adelman, CEO of bitcoin rewards app Lolli, in an email. “Bitcoin’s recent climb to over 50% market dominance in the crypto markets reflects a growing demand for bitcoin among institutional and retail investors as a highly secure, decentralized holding that has proven its value over time.”

“The recent burst of bitcoin ETF applications from leading institutions like BlackRock, Fidelity, and Invesco shows that new regulatory guidelines are the greenlight institutions have been waiting for to launch bitcoin-based products and meet client demand,” Adelman added.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

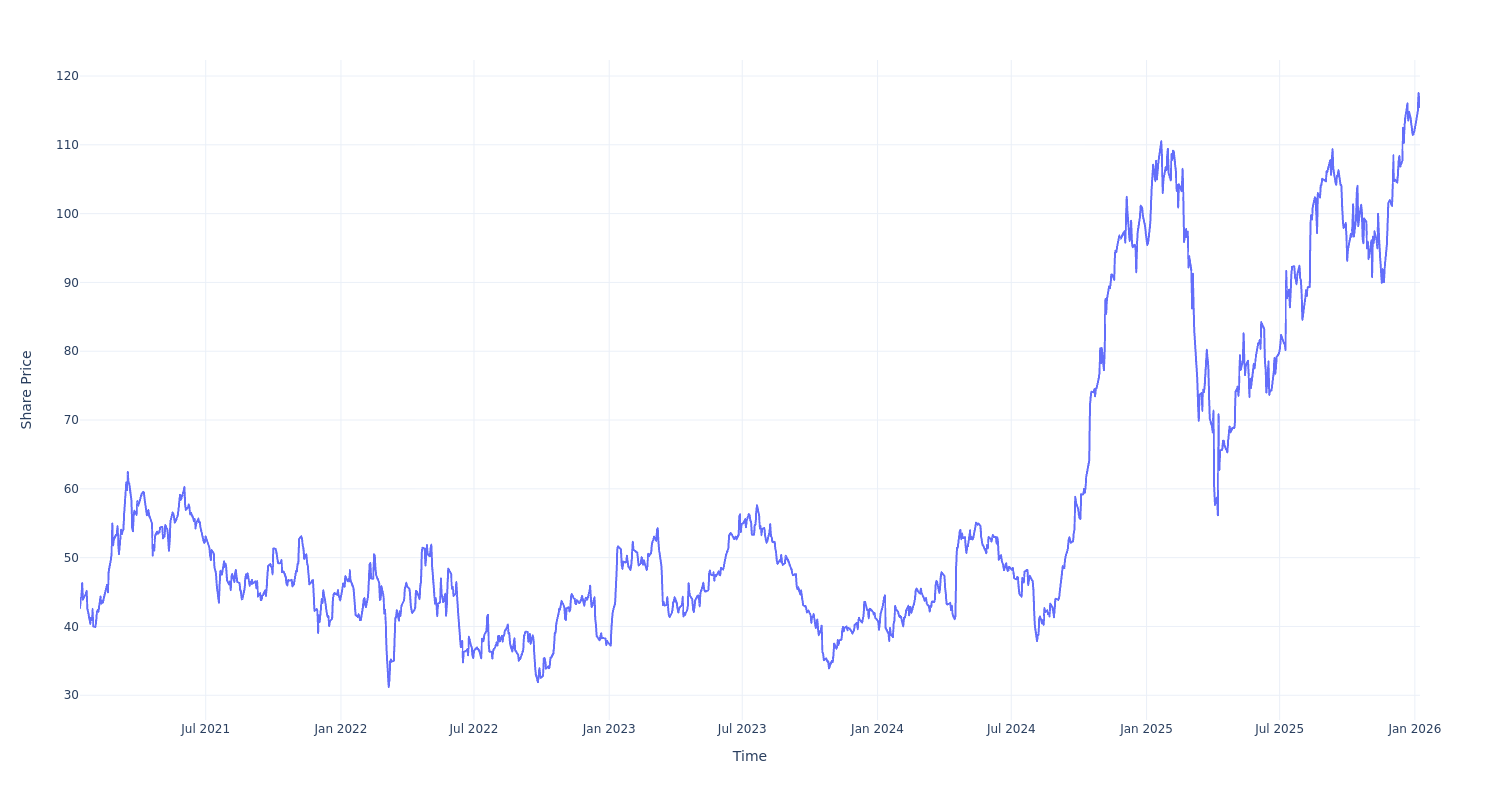

If you had put $100 into the Invesco S&P 500 Momentum ETF five years back, it would be valued at this amount now

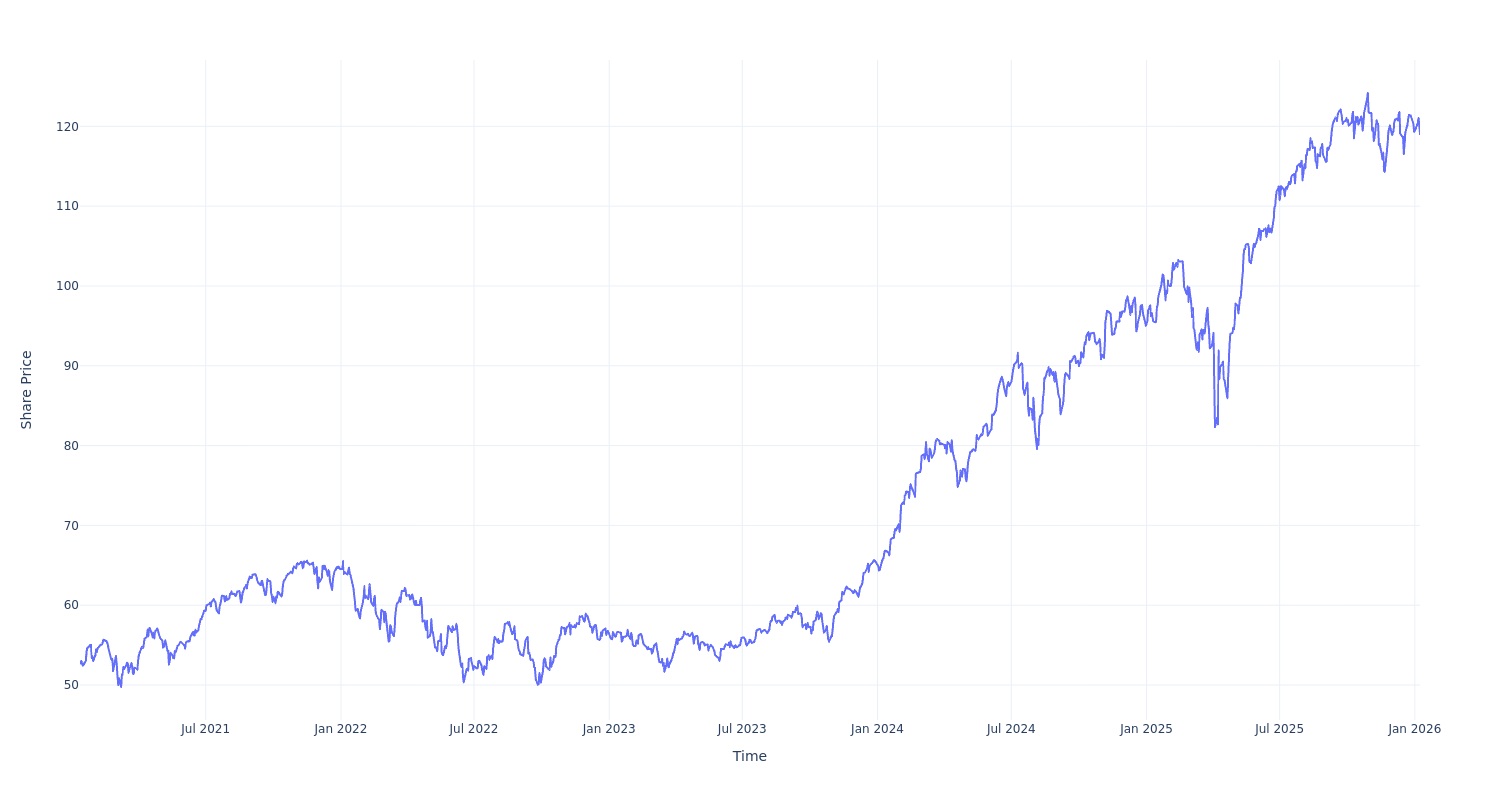

Here's What $100 Invested in United Airlines Holdings Five Years Ago Would Amount to Now