Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア63.07%

Bitgetの新規上場 : Pi

BTC/USDT$109046.00 (-0.52%)恐怖・強欲指数71(強欲)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨SOONNEWビットコイン現物ETFの純流入総額(+$385.4M(1日)、+$3.14B(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア63.07%

Bitgetの新規上場 : Pi

BTC/USDT$109046.00 (-0.52%)恐怖・強欲指数71(強欲)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨SOONNEWビットコイン現物ETFの純流入総額(+$385.4M(1日)、+$3.14B(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア63.07%

Bitgetの新規上場 : Pi

BTC/USDT$109046.00 (-0.52%)恐怖・強欲指数71(強欲)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨SOONNEWビットコイン現物ETFの純流入総額(+$385.4M(1日)、+$3.14B(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Act I : The AI Prophecyの価格ACT

JPY

未上場

¥9JPY

+1.59%1D

本日08:55(UTC)時点のAct I : The AI Prophecy(ACT)価格は換算で¥9 JPYです。

ACTからJPYへの交換

ACT

JPY

1 ACT = 9 JPY.現在の1 Act I : The AI Prophecy(ACT)からJPYへの交換価格は9です。レートはあくまで参考としてご活用ください。更新されました。

Bitgetは、主要取引プラットフォームの中で最も低い取引手数料を提供しています。VIPレベルが高ければ高いほど、より有利なレートが適用されます。

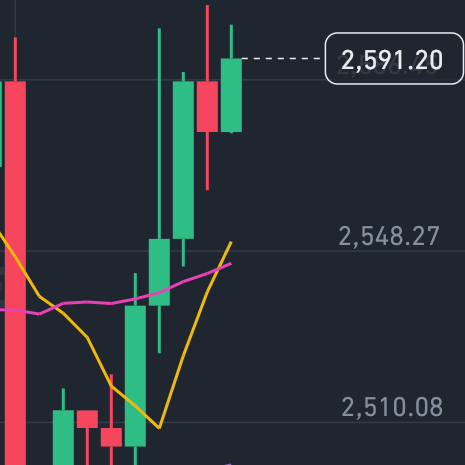

Act I : The AI Prophecyの価格チャート(ACT/JPY)

最終更新:2025-05-28 08:55:03(UTC+0)

時価総額:¥8,536,963,551.32

完全希薄化の時価総額:¥8,536,963,551.32

24時間取引量:¥6,236,348,286.42

24時間取引量 / 時価総額:73.05%

24時間高値:¥9.24

24時間安値:¥8.78

過去最高値:¥135.78

過去最安値:¥0.02087

循環供給量:948,245,000 ACT

総供給量:

948,244,971.9ACT

流通率:100.00%

最大供給量:

--ACT

BTCでの価格:0.{6}5725 BTC

ETHでの価格:0.{4}2363 ETH

BTC時価総額での価格:

¥329,543.93

ETH時価総額での価格:

¥48,515.2

コントラクト:

GJAFwW...gUnpump(Solana)

もっと

Act I : The AI Prophecyの価格は今日上がると思いますか、下がると思いますか?

総投票数:

上昇

0

下落

0

投票データは24時間ごとに更新されます。これは、Act I : The AI Prophecyの価格動向に関するコミュニティの予測を反映したものであり、投資アドバイスと見なされるべきではありません。

Act I : The AI ProphecyのAI分析レポート

本日の暗号資産市場のハイライトレポートを見る

本日のAct I : The AI Prophecyの現在価格(JPY)

現在、Act I : The AI Prophecyの価格は¥9 JPYで時価総額は¥8.54Bです。Act I : The AI Prophecyの価格は過去24時間で1.59%上昇し、24時間の取引量は¥6.24Bです。ACT/JPY(Act I : The AI ProphecyからJPY)の交換レートはリアルタイムで更新されます。

1 Act I : The AI Prophecyは換算でいくらですか?

現在のAct I : The AI Prophecy(ACT)価格は換算で¥9 JPYです。現在、1 ACTを¥9、または1.110752007488874 ACTを¥10で購入できます。過去24時間のACTからJPYへの最高価格は¥9.24 JPY、ACTからJPYへの最低価格は¥8.78 JPYでした。

Act I : The AI Prophecyの価格履歴(JPY)

Act I : The AI Prophecyの価格は、この1年で+132.40%を記録しました。直近1年間のJPY建ての最高値は¥135.78で、直近1年間のJPY建ての最安値は¥0.02087でした。

時間価格変動率(%) 最低価格

最低価格 最高価格

最高価格

最低価格

最低価格 最高価格

最高価格

24h+1.59%¥8.78¥9.24

7d+1.83%¥8.21¥10.42

30d+10.32%¥6.98¥12.91

90d-72.16%¥6.15¥36.5

1y+132.40%¥0.02087¥135.78

すべての期間+108.16%¥0.02087(2024-10-19, 221 日前 )¥135.78(2024-11-14, 195 日前 )

Act I : The AI Prophecyの最高価格はいくらですか?

Act I : The AI Prophecyの過去最高値(ATH)は¥135.78 JPYで、2024-11-14に記録されました。Act I : The AI ProphecyのATHと比較すると、Act I : The AI Prophecyの現在価格は93.37%下落しています。

Act I : The AI Prophecyの最安価格はいくらですか?

Act I : The AI Prophecyの過去最安値(ATL)は¥0.02087 JPYで、2024-10-19に記録されました。Act I : The AI ProphecyのATLと比較すると、Act I : The AI Prophecyの現在価格は43038.51%上昇しています。

Act I : The AI Prophecyの価格予測

2026年のACTの価格はどうなる?

ACTの過去の価格パフォーマンス予測モデルによると、ACTの価格は2026年に¥11.99に達すると予測されます。

2031年のACTの価格はどうなる?

2031年には、ACTの価格は+11.00%変動する見込みです。 2031年末には、ACTの価格は¥24.56に達し、累積ROIは+173.38%になると予測されます。

注目のキャンペーン

よくあるご質問

Act I : The AI Prophecyの現在の価格はいくらですか?

Act I : The AI Prophecyのライブ価格は¥9(ACT/JPY)で、現在の時価総額は¥8,536,963,551.32 JPYです。Act I : The AI Prophecyの価値は、暗号資産市場の24時間365日休みない動きにより、頻繁に変動します。Act I : The AI Prophecyのリアルタイムでの現在価格とその履歴データは、Bitgetで閲覧可能です。

Act I : The AI Prophecyの24時間取引量は?

過去24時間で、Act I : The AI Prophecyの取引量は¥6.24Bです。

Act I : The AI Prophecyの過去最高値はいくらですか?

Act I : The AI Prophecy の過去最高値は¥135.78です。この過去最高値は、Act I : The AI Prophecyがローンチされて以来の最高値です。

BitgetでAct I : The AI Prophecyを購入できますか?

はい、Act I : The AI Prophecyは現在、Bitgetの取引所で利用できます。より詳細な手順については、お役立ちの購入方法 ガイドをご覧ください。

Act I : The AI Prophecyに投資して安定した収入を得ることはできますか?

もちろん、Bitgetは戦略的取引プラットフォームを提供し、インテリジェントな取引Botで取引を自動化し、利益を得ることができます。

Act I : The AI Prophecyを最も安く購入できるのはどこですか?

戦略的取引プラットフォームがBitget取引所でご利用いただけるようになりました。Bitgetは、トレーダーが確実に利益を得られるよう、業界トップクラスの取引手数料と流動性を提供しています。

Act I : The AI Prophecyの集中度別保有量

大口

投資家

リテール

Act I : The AI Prophecyの保有時間別アドレス

長期保有者

クルーザー

トレーダー

coinInfo.name(12)のリアル価格チャート

Act I : The AI Prophecyのグローバル価格

現在、Act I : The AI Prophecyは他の通貨の価値でいくらですか?最終更新:2025-05-28 08:55:03(UTC+0)

ACT から MXN

Mexican Peso

Mex$1.21ACT から GTQGuatemalan Quetzal

Q0.48ACT から CLPChilean Peso

CLP$58.65ACT から HNLHonduran Lempira

L1.63ACT から UGXUgandan Shilling

Sh228.09ACT から ZARSouth African Rand

R1.12ACT から TNDTunisian Dinar

د.ت0.19ACT から IQDIraqi Dinar

ع.د81.89ACT から TWDNew Taiwan Dollar

NT$1.87ACT から RSDSerbian Dinar

дин.6.47ACT から DOPDominican Peso

RD$3.69ACT から MYRMalaysian Ringgit

RM0.26ACT から GELGeorgian Lari

₾0.17ACT から UYUUruguayan Peso

$2.6ACT から MADMoroccan Dirham

د.م.0.58ACT から AZNAzerbaijani Manat

₼0.11ACT から OMROmani Rial

ر.ع.0.02ACT から KESKenyan Shilling

Sh8.07ACT から SEKSwedish Krona

kr0.6ACT から UAHUkrainian Hryvnia

₴2.61- 1

- 2

- 3

- 4

- 5

今日の暗号資産価格

Bitgetに新規上場された通貨の価格

新規上場

暗号資産はどこで購入できますか?

動画セクション - 素早く認証を終えて、素早く取引へ

Bitgetで本人確認(KYC認証)を完了し、詐欺から身を守る方法

1. Bitgetアカウントにログインします。

2. Bitgetにまだアカウントをお持ちでない方は、アカウント作成方法のチュートリアルをご覧ください。

3. プロフィールアイコンにカーソルを合わせ、「未認証」をクリックし、「認証する」をクリックしてください。

4. 発行国または地域と身分証の種類を選択し、指示に従ってください。

5. 「モバイル認証」または「PC」をご希望に応じて選択してください。

6. 個人情報を入力し、身分証明書のコピーを提出し、自撮りで撮影してください。

7. 申請書を提出すれば、本人確認(KYC認証)は完了です。

Bitgetを介してオンラインでAct I : The AI Prophecyを購入することを含む暗号資産投資は、市場リスクを伴います。Bitgetでは、簡単で便利な購入方法を提供しており、取引所で提供している各暗号資産について、ユーザーに十分な情報を提供するよう努力しています。ただし、Act I : The AI Prophecyの購入によって生じる結果については、当社は責任を負いかねます。このページおよび含まれる情報は、特定の暗号資産を推奨するものではありません。

ACTからJPYへの交換

ACT

JPY

1 ACT = 9 JPY.現在の1 Act I : The AI Prophecy(ACT)からJPYへの交換価格は9です。レートはあくまで参考としてご活用ください。更新されました。

Bitgetは、主要取引プラットフォームの中で最も低い取引手数料を提供しています。VIPレベルが高ければ高いほど、より有利なレートが適用されます。

Act I : The AI Prophecyの評価

コミュニティからの平均評価

4.4

このコンテンツは情報提供のみを目的としたものです。

Bitgetインサイト

DailyCryptoDive

6時

🚀 Crypto Market Update – May 28, 2025

🔥 Top Headlines

• Trump Media plans to buy $2.5B in Bitcoin, boosting market confidence.

• U.S. Senator Cynthia Lummis introduces the BITCOIN Act, aiming to buy 1M $BTC for national reserves.

• Michael Saylor predicts $100T market cap for $BTC in the future.

• Pi Network launches Mainnet; 102M $PI withdrawn in 72 hours.

• Bitget upgrades Spot Margin Trading system for smoother performance.

📊 Market Snapshot – May 28, 2025

• Bitcoin ($BTC ): $109,000 – Steady rise after Trump Media news

• Ethereum ($ETH ): $2,450 – Mild recovery, buyer interest strong

• $XRP : $2.31 – Under pressure, facing bearish trends

• Bitget Token ($BGB ): $5.32 – Consolidating near support level

• Pi Network ($PI ): Mainnet LIVE – Massive interest, 102M PI withdrawn in 72 hours

📌 Insight

Big money is entering the market. Institutions are going long on Bitcoin, governments are watching closely, and altcoins are seeing mixed action. Keep your eyes on $BTC , $BGB , and $PI this week.

⸻

Stay sharp, trade smart. More updates coming soon on Bitget. 💼📈

BTC+0.07%

BGB-0.16%

𒐪

8時

wanting to break things just to see them burn is a fundamentally adolescent, regressive impulse

there is an alternate form of destruction for the sake of revealing how things are, or how they might be; a more forward-looking and intentional act of broadcast via radical action

ACT-0.31%

FORM0.00%

abdulyeken

8時

Goals focus on economic growth and integrating crypto into finance, but there’s controversy over conflicts of interest.

Positives include industry support and potential innovation, while negatives involve ethical concerns and regulatory risks.

Reactions are mixed, with the crypto industry largely positive, but critics raise corruption and security issues.

Market trends show increased bitcoin focus, with potential for broader adoption, though debates continue.

Overview

The Trump administration’s cryptocurrency policies, as of May 27, 2025, reflect a significant shift toward embracing digital assets, aiming to position the United States as a global leader in this space. Here’s a breakdown for a clearer understanding:

Background and Context

President Trump has taken steps to integrate cryptocurrencies into national policy, contrasting with previous regulatory approaches. This includes creating a Strategic Bitcoin Reserve, treating bitcoin as a reserve asset like gold, and easing regulations to foster industry growth.

Key Policies and Actions

Established a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile on March 6, 2025, to centralize digital asset management.

Rolled back SEC enforcement tactics, dropped lawsuits like against Ripple, and hosted crypto roundtables.

Issued new bank charters to crypto firms and repealed the SAB 121 accounting rule, making it easier for banks to engage with crypto.

Appointed pro-crypto leaders, like Brian Quintenz to the CFTC, and launched a President’s Council of Advisers on Digital Assets.

Supported bitcoin mining to strengthen the economy and grid, exploring blockchain-based payment systems.

Goals and Intentions

The main goals are to make the U.S. the "crypto capital of the world," integrate cryptocurrencies into the $100 trillion capital markets, and drive technological and economic leadership. This includes tokenizing equities and supporting stablecoins for broader financial inclusion.

Positives and Negatives

Positives include increased industry confidence, potential for economic growth, and resolving past issues with seized crypto management. However, negatives include concerns over Trump’s family profiting from crypto (e.g., a $TRUMP meme coin), raising ethical and conflict-of-interest issues. The Federal Reserve’s restrictive stance on banks also limits full integration.

Reactions and Market Trends

The crypto industry largely welcomes these changes, seeing them as a "180 pivot" from past policies. Critics, like Senator Elizabeth Warren, argue these policies pose national security risks and corruption. Market trends show a focus on bitcoin, with expectations of new crypto-focused banks and blockchain adoption, though debates over regulatory capture persist.

This overview aims to provide a balanced view, acknowledging the complexity and ongoing discussions around these policies.

Survey Note: Detailed Analysis of Trump Administration’s Cryptocurrency Policies

As of 03:56 AM WAT on Tuesday, May 27, 2025, the Trump administration’s approach to cryptocurrency policies marks a significant departure from previous regulatory frameworks, emphasizing innovation, economic integration, and global leadership in digital assets. This detailed analysis expands on the overview, incorporating all relevant information to provide a comprehensive understanding for stakeholders, policymakers, and the public.

The administration has implemented several pivotal actions to reshape the cryptocurrency landscape in the U.S. On March 6, 2025, President Donald J. Trump signed an executive order establishing the Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, as detailed in the White House fact sheet . This initiative treats bitcoin as a reserve asset, akin to gold, and aims to centralize ownership, control, and management of digital assets within the federal government for proper oversight and strategic positioning.

Additional actions include:

Regulatory rollbacks by the SEC, such as dropping the lawsuit against Ripple and hosting crypto roundtables to engage with industry stakeholders.

The Office of the Comptroller of the Currency (OCC) issuing new bank charters to crypto firms, facilitating greater financial integration.

The FDIC, under Travis Hill, exposing "Choke Point 2.0," a perceived effort to restrict banks from working with crypto companies, as noted in recent reports.

Repeal of SAB 121, an accounting rule that previously restricted banks from crypto custody, seen as an early win for the industry .

Appointment of Brian Quintenz to lead the CFTC, signaling a pro-crypto regulatory approach.

Launch of the President’s Council of Advisers on Digital Assets to guide policy development and exploration of blockchain-based payment systems by bank regulators.

Support for bitcoin mining, aiming to strengthen the U.S. economy and energy grid, with incentives for new power infrastructure.

These actions collectively aim to create a more welcoming environment for cryptocurrencies, contrasting with the enforcement-heavy approach of the previous administration.

Goals and Strategic Objectives

The overarching goals, as articulated in official statements and industry analyses, include positioning the U.S. as the "crypto capital of the world." This involves integrating cryptocurrencies into the $100 trillion capital markets, far beyond the current $3 trillion crypto market, as highlighted in recent CNBC coverage . Specific objectives include:

Treating bitcoin as a strategic reserve asset, leveraging its scarcity and security (often referred to as "digital gold") to enhance the U.S.’s global financial position.

Tokenizing the equities market and supporting stablecoins to facilitate broader financial inclusion and innovation.

Centralizing digital asset management to resolve past issues of disjointed handling of seized cryptocurrencies, scattered across federal agencies.

Supporting bitcoin mining to bolster the economy and grid, with incentives for new power infrastructure to meet energy demands.

These goals reflect a forward-thinking approach, with President Trump consistently advocating for embracing digital assets, stating, "I am very positive and open-minded to cryptocurrency companies, and all things related to this new and burgeoning industry. Our country must be the leader in the field," as noted in White House communications.

Positives and Benefits

The administration’s policies have several potential benefits, as evidenced by industry reactions and economic analyses:

Increased Industry Confidence: The crypto industry feels more welcome in Washington, D.C., with stakeholders like Coinbase CEO Brian Armstrong and Castle Island Ventures’ Nic Carter praising the regulatory shift. Armstrong’s donations to Trump’s campaign are seen as paying off, with Coinbase stock benefiting post-election .

Economic Growth Potential: Integrating crypto into traditional finance could unlock new economic opportunities, with 73% of U.S. crypto holders wanting the U.S. to be a global leader, according to the National Cryptocurrency Association (Stu Alderoty).

Technological Leadership: The focus on blockchain technology and bitcoin mining could position the U.S. at the forefront of innovation, with early wins for companies like MARA Holdings and OBM in the mining sector.

Resolution of Past Issues: The Strategic Bitcoin Reserve addresses the previous lack of clear policy for managing seized cryptocurrencies, which cost taxpayers over $17 billion in premature sales, ensuring a more cohesive approach.

Negatives and Challenges

Despite the positives, several challenges and criticisms have emerged:

Conflicts of Interest: President Trump’s family has profited significantly from crypto ventures, collecting $320 million in fees from a new cryptocurrency and increasing their net worth by $2.9 billion, as reported by The New York Times and CBS News . This has raised ethical concerns, particularly with the launch of a $TRUMP meme coin, criticized for adding billions to their wealth Trump's Memecoin Dinner Contest Earns Insiders $900,000 in Two Days.

Federal Reserve Restrictions: The Federal Reserve remains a "structural holdout," restricting banks from crypto-related activities, which could limit the full potential of these policies, as noted in recent Federal Reserve press releases .

National Security Risks: Critics, including Senator Elizabeth Warren, argue that Trump’s stablecoin and crypto policies pose national security risks, weakening regulatory guardrails, as expressed in an X post .

Appearance of Impropriety: The involvement of a lobbyist with crypto ties, who was later "exiled" from the White House after influencing Trump’s Truth Social post about including XRP, SOL, and ADA in the strategic reserve, has raised concerns about regulatory capture, as discussed in multiple

Political and Economic Context

The political landscape shows a mix of support and resistance. The administration’s policies have garnered bipartisan momentum in Congress for stablecoin and market structure legislation, but some bills, like the GENIUS Act, were rejected due to concerns over Trump’s personal involvement, as noted in an X post by

@Jason

. Economically, the administration is targeting the integration of crypto into the $100 trillion capital markets, with expectations of new banks focusing on crypto and stablecoins, as per industry analyses. However, the Federal Reserve’s stance and Trump’s 43% job approval rating add complexity to the economic context.

Stakeholder Reactions

Reactions from various stakeholders highlight the polarized nature of these policies:

Crypto Industry: Leaders like Paul Grewal (Coinbase), Veronica McGregor (Exodus), and Faryar Shirzad (Coinbase) have celebrated the "180 pivot" from Biden-era policies, as reported in CNBC . Bitcoin maximalists, as seen in an X post by

@BitcoinPierre

, support the focus on bitcoin in the strategic reserve.

Critics: Robert Reich, in an X post, accused the administration of corruption, citing eased regulations while Trump profits . Early blowback on including multiple cryptocurrencies in the reserve caused rifts, later resolved by narrowing to bitcoin, as reported in CNBC Pro-Trump Techies Enraged by Crypto Reserve Plan Causing

Lawmakers: The rejection of the GENIUS Act reflects concerns over Trump’s involvement, with some lawmakers citing the appearance of impropriety, as discussed in X posts.

Market Trends and Implications

Market trends indicate a strong focus on bitcoin, with the Strategic Bitcoin Reserve elevating its status as a reserve asset. Industry experts, like Nic Carter, expect new banks focusing on crypto and stablecoins, with support for blockchain technology integration across financial systems. The market has reacted positively, with stakeholders expressing optimism about regulatory clarity, but concerns about ethical issues and regulatory capture, as seen in X discussions, introduce caution. The administration’s target of integrating crypto into the $100 trillion capital markets suggests long-term growth potential, though current debates highlight the need for balanced regulation.

Summary Table: Key Aspects of Cryptocurrency Policies

Aspect

Details

Key Actions

Strategic Bitcoin Reserve, regulatory rollbacks, new bank charters, support for mining.

Goals

Make U.S. crypto capital, integrate into finance, drive economic growth.

Positives

Industry support, economic potential, resolved asset management issues.

Negatives

Conflicts of interest, Federal Reserve restrictions, national security risks.

Reactions

Industry positive, critics raise corruption, lawmakers mixed on legislation.

Market Trends

Bitcoin focus, new crypto banks expected, blockchain integration potential.

This detailed analysis provides a comprehensive view, ensuring all relevant information is considered, from official actions to stakeholder reactions and market implications, as of the current date

X-0.82%

WAT-6.74%

Joe Weisenthal

14時

RT @AstorAaron: @TheStalwart @RobRipperda @conorsen Tennessee is going that way too. University of Tennessee has much higher average ACT sc…

ACT-0.31%

Othnielxt

15時

THE ART OF SCALPING $CRV ON A 1-HOUR CHART

Scalping tends to bring up images of fast trades and even faster charts—but when $CRV is on the table, the timeframe often reveals a calmer, more strategic pace. It offers just enough data to reduce noise, but still enough movement to act on quickly.

CORE TECHNICAL INDICATORS FOR STRATEGIC ENTRY

EMA(5) and EMA(10) showed up as reliable dynamic support and resistance. Momentum often picked up when price bounced off EMA(5), especially on rising volume.

RSI(6) moved fast—catching overbought or oversold conditions with minimal lag. That sharp drop below 30 or spike above 70 gave heads-ups on possible reversals.

MACD crossovers, particularly when DIF crossed above DEA, tended to signal clean short-term entries with momentum backing the trade.

For instance, when $CRV hovered near EMA(5) at 0.00000717 and RSI(6) floated above 50, the odds tilted toward a bounce—one worth considering with a tight stop.

VOLUME AND LIQUIDITY AS CONFIRMATION TOOLS

Volume sat at 402.4944 with a 5-period average around 2.30K. Breakouts on strong volume stood out as legit, while thin retracements often opened up safer, lower-risk entry zones.

When $CRV moved through 0.00000732 with strong volume behind it, a clean move toward 0.00000745 often followed. The price action told the story—volume confirmed it.

OPTIMAL TRADE TIMING FOR CONSISTENT EXECUTION

The most meaningful trades happened during BTC-related volatility spikes—usually around the U.S. and European open.

Flat, indecisive candles in tight ranges (like 0.00000720–0.00000727) rarely led anywhere. Best to sit out and wait for something with more conviction.

STRUCTURED RISK MANAGEMENT TECHNIQUES

Stop-losses worked best just under recent swing lows or EMA(10)—around 0.00000706 in some setups.

Risk-reward ratios near 1:1.5 kept things sane. Say an entry happened at 0.00000727—then a TP at 0.00000735 with an SL at 0.00000720 gave the setup breathing room.

Minimal leverage (2x–5x) was favored, especially given how $CRV liked to whipsaw when volume thinned out.

MAINTAINING MENTAL DISCIPLINE IN HIGH-FREQUENCY SETUPS

A limit of two or three high-probability trades per day kept mental fatigue at bay.

Small losses got treated as part of the process—less about chasing wins, more about showing up consistently.

CONCLUSION

Scalping $CRV off the 1-hour chart brought a surprising blend of pace and clarity. EMAs, RSI, MACD, and volume shifts told the story—one scalp at a time. The key seemed to lie in reading the rhythm without forcing the trade.

$CRV $BTC

BTC+0.07%

X-0.82%

Act I : The AI Prophecyの追加情報