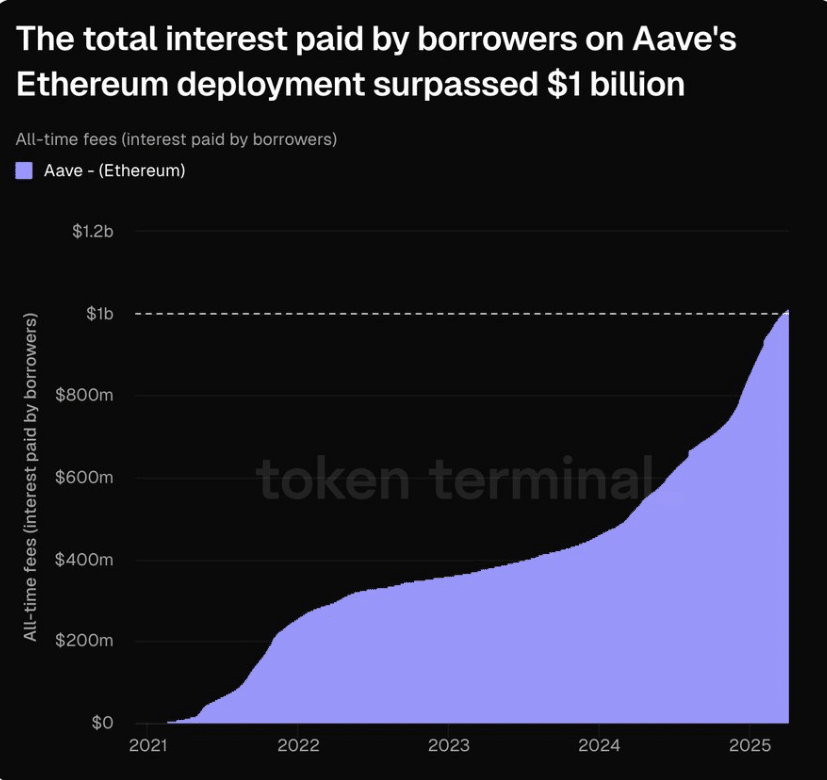

AAVE Token Slides 21% Despite Record $1 Billion in Borrower Interest

- AAVE drops 21% despite $1B borrower interest milestone; protocol usage clashes with token’s market underperformance.

- Futures buy volume sinks to 116.65M, open contracts dip as traders avoid bets amid price uncertainty.

AAVE saw its token price drop 20.69% in 24 hours, even as borrowers on its Ethereum-based protocol paid over $1 billion in cumulative interest. Data from Token Terminal confirms the interest milestone, reflecting heightened activity across AAVE’s lending pools. The divergence between protocol usage and token performance raises questions about investor sentiment.

Protocol Demand Clashes With Token Weakness

The $1 billion interest figure signals robust user engagement. Borrowers pay interest to access liquidity, while lenders earn yields from deposits. Higher interest volumes suggest increased borrowing demand, often interpreted as confidence in the platform’s security and liquidity depth. For AAVE, this activity translates to revenue—earning a portion of the interest—which funds development and tokenholder incentives.

Source_ Token Terminal

Source_ Token Terminal

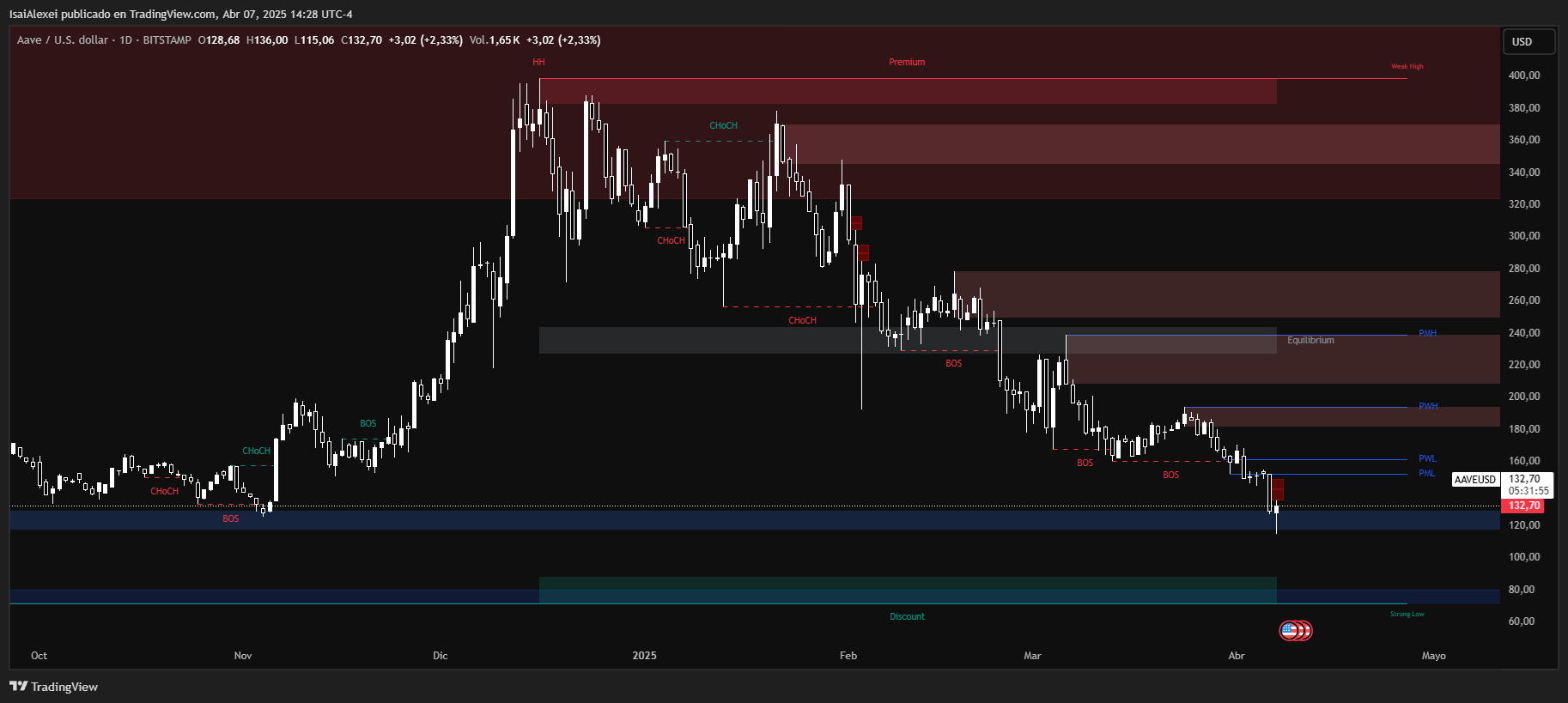

However, AAVE’s token chart tells a different story. The 21% price decline aligns with broader crypto market trends but underperforms peers. Futures trading data reveals skepticism: open contracts fell to 917,230, indicating fewer new positions. Buy volume dropped to 116.65 million, suggesting traders are avoiding long bets.

Source: Tradingview

Source: Tradingview

AAVE’s buy volume contraction points to a seller-dominated market, where exits outpace new entrants. This contrasts with the protocol’s operational health, creating a paradox.

Source: Messari

Source: Messari

ETHNews analysts note that protocol revenue and token value don’t always align. AAVE’s fees stem from user activity, while its token price hinges on speculative demand. Recent underperformance may reflect concerns over competition, regulatory risks, or profit-taking after prior gains.

Source: Messari

Source: Messari

The disconnect underscores a challenge for decentralized finance (DeFi) tokens: convincing markets that protocol success benefits holders. AAVE’s model shares revenue with stakeholders, but tokenholders appear unmoved. Bitcoin and Ethereum often rise on network usage, but DeFi tokens like AAVE face steeper scrutiny.

For now, AAVE’s trajectory hinges on two factors: whether protocol revenue can stabilize token sentiment, and if futures traders regain confidence. History shows such gaps occasionally close, but timing remains uncertain.

Source: Tradingview

Source: Tradingview

The current price of Aave (AAVE) is $132.26 USD, with a market capitalization of approximately $1.996 billion and a 24-hour trading volume of $636.6 million. In the past 24 hours, AAVE has dropped by 2.59%, and over the last 7 days, it has fallen 16.5%, signaling a notable short-term correction.

However, on the 30-day timeframe, AAVE is still up over 31%, which shows that its mid-term trend remains bullish despite recent volatility. In the past 24 hours, the price ranged between $114.93 and $135.78, indicating strong price action and liquidity.

Descargo de responsabilidad: El contenido de este artículo refleja únicamente la opinión del autor y no representa en modo alguno a la plataforma. Este artículo no se pretende servir de referencia para tomar decisiones de inversión.

También te puede gustar

Estrategia adquiere 15,355 Bitcoin por $1.4 mil millones, incrementando su reserva a 553,555 BTC

Estrategia capitaliza el incremento en el valor cripto, aprovechando la venta de acciones para financiar una sustancial compra de Bitcoin.

Principales 5 ganadores de la semana (21-28 de abril): TAI, PENGU, NEIRO, GRIFFAIN, TURBO

John Deaton asegura que el fundador de FTX debe cumplir plenamente...

¿Se deben borrar los bitcoins de Satoshi Nakamoto?